Bitcoin is a ground-breaking technology that has changed the way people conduct transactions in the present age. As a digital form of money, it cannot be felt physically, and its network is stored on the Bitcoin Blockchain. Because this technology is transparent, users can easily access it.

Storing Bitcoin

Learning how to store funds, using digital payment systems is one of the most important topics on cryptocurrency to avoid theft and hacking attempt. It is not entirely true when a person claims to hold Bitcoin in a wallet. Instead, a wallet is like a key that unlocks a certain amount of circulation. It is impossible to transfer Bitcoin from one wallet to another wallet; rather, it is transferred from one user to another A wallet address is akin to an email address. Payment can be sent from and received at a wallet address.

Also, the Bitcoin address has two components: One is the public key, which is simply the string of 34-character wallet address that can be shared among users on the network. The other part is the private key, which must be kept a secret. This is to prevent any user from accessing any funds in the account. It is similar to having a password that can be used to access a social media account. When a transaction is about to begin, a request is broadcast across the network. The transfer is only authorized by the sender’s private key but checked and verified by the miners.

Furthermore, another recommendation for securing funds safely is to have a clean and safe Operating System. This implies that it must be free of malware, virus, and other harmful programs. These can access the computer system hardware, and seek information on your wallet address, and send sensitive data back to the attacker. A user must keep his computer system as clean as possible. However, an infected computer system should either be replaced or formatted.

You may decide to make a copy of your wallet file, and store it with any of the cloud services. Once you encrypt your wallet file with a password, then the funds in it are inaccessible to other users. Asides from storing an electronic copy of the file, you can print it out in a form known as a paper wallet. This is one of the safest methods of storing Bitcoin holdings. However, this must be kept in a safe location.

Potential Vulnerabilities

Even though Bitcoin is a testament to the growing technological advancement, it has its major downsides. The potential hazards facing Bitcoin can be very sensitive. The mining process is what secures the integrity of the blockchain, and makes it work. Yet, with increased difficulty in the operation due to the increase in transaction rate, more attention has been placed on this domain than ever before. With 51% of the network power focused on them, this leaves the possibility of a potential attack a concerning one.

Moreover, there are certain things a group with 51% of a network hash rate can do. For example, they can decide to prevent some transaction from gaining verification, thereby rendering them invalid. Although this is pure speculation, it is still a valid possibility.

Furthermore, the government of some countries is wary of the threats the rise of the Bitcoin system poses to their monetary policies. Hence, they resort to banning it. Indeed, many hearings have been presented to explain how beneficial cryptocurrency can be, and how much a nation, as a whole, stands to gain from this technology. Another way the government can hinder Bitcoin operation is to place barriers on exchange options. This would effectively impede the movement, storage, and privacy of Bitcoin. Consequently, The adoption of this technology would be stalled, and significantly increase the volatility of its market.

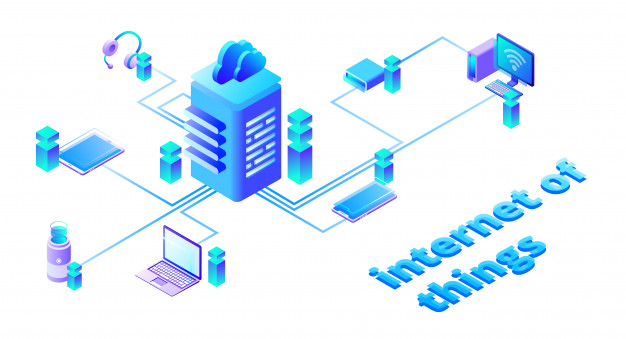

The Internet of Things

If society wants to move forward, we must not only gain information about the things we use, but these things we use must be able to collect information and share information independently. Billions of mundane things have been activated, linked online, and made to deliver results in real-time. This advancement has made “the internet of things” the next big thing for humanity.

As the accessibility to the internet increases, it brings its users together under one information processing system, akin to the way it works in the nervous system of living organisms. The Blockchain behaves similarly. All information on the network (Block) is stored publicly in the Blockchain. Blockchain technology perhaps describes the core component of “the internet of things”, where information can be provided and shared anywhere across the globe because it is scalable and is not subject to ownership. That is, these “things” can communicate among themselves to provide results for whoever seeks it.

Also, the Blockchain and some other reputable platforms like Bitcoin Revolution can form an adaptable system where addresses communicate amongst themselves to initiate situations where pre-established conditions are met. The Blockchain proposes a situation whereby information can be shared without the need for a centralized system. Since “information is power”, this kind of advancement poses so much excitement with a very powerful information system.

Bitcoin vs Gold

This particular debate has been persistent among investors since Bitcoin gained global recognition. Gold, on the other hand, has been used as a form of currency for thousands of years. What exactly makes Bitcoin similar to a precious metal like gold? To properly analyze the value of Bitcoin with respect to Gold, the attributes of both must be compared. Indeed, people often call Bitcoin “the Gold of the 21st century”.

Gold has achieved its renown because it is scarce, aesthetically beautiful to behold, almost indestructible, and it is used for industrial purposes. Bitcoin has all these and adds to itself the properties of divisibility and portability. Also, it is predicted that the value of Bitcoin for a US Dollar will be twice that of Gold presently.

In conclusion, despite all the downsides of Bitcoin, as mentioned above, the so-called “Gold of the 21st century” is the currency for the future.