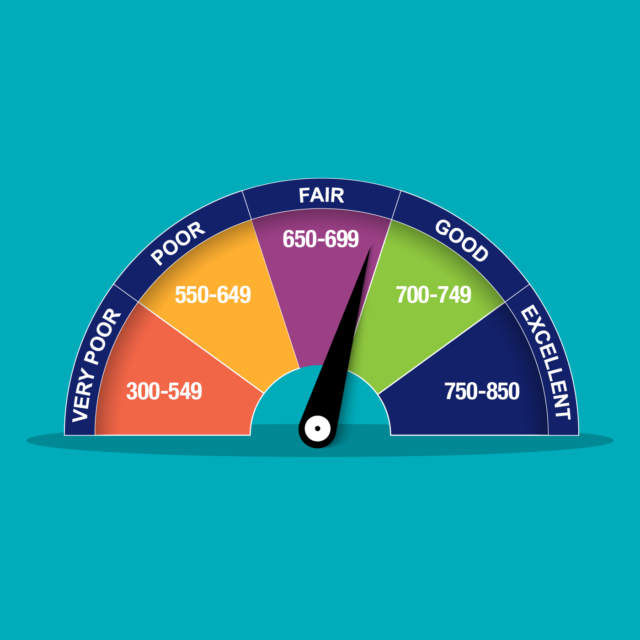

Your credit score can have a pretty major impact on your life. It influences whether you can take out large purchases and loans, and a lot of other things too. All sorts of things can impact your credit score, such as taking out a personal loan or racking up credit card debt. For that reason, it’s usually a good idea to make it your personal mission to have a high credit score.

Of course, there’s one thing that most people need to know when they’re trying to improve their credit score. They need to know how long it’s going to take. Some purchases can be time sensitive, after all, and if you have a terrible credit score you may end up struggling to make a certain purchase. Thankfully, we’re here to answer all of your questions about how long it’s going to take to improve your credit score. For more information regarding improving your credit score, visit CreditNinja.com.

How Long It Takes

So how long does it take to improve your credit score? You may not like the answer, but ultimately there is no universal answer to the question. You can’t really tell how long it’ll take for your credit score to change. What makes it even worse is that you can’t tell how much it’s going to change either. It can depend on things such as how long it takes certain businesses to update the credit report, since different businesses update these things at different times. In some cases, your credit report may take up to a number of weeks to update after you have made a change.

Unfortunately, there’s also the other aspect that you don’t know how much change is going to take place, which can be quite frustrating when you are attempting to make an application for something and you need a certain credit score to proceed. It’s one of those horrible things in life that you can’t really control all that much. All you can do really is keep an eye on the credit score and monitor the changes as you do things to improve your credit score.

It’s worth remembering that it will also be determined by the amount of damage that’s been taken to your credit score. You aren’t going to go from a very poor credit score to a score with flying colors overnight in most cases. If your credit score is truly terrible then there’s a chance that it could take years for you to make changes, whereas it may not take as long if you have only a few minor black marks next to your name.

How Long Information Stays on Your Credit Score

Some negative information such as when you have made late payments or gone through Chapter 13 bankruptcy is going to stay on your report for seven years. Bigger problems like Chapter 7 bankruptcies can linger around for as long as 10 years. As time goes on, the impact of certain negative reports can have less of an effect, though it can take a very long time to come back from serious problems.

Improving Your Credit Score

Often, getting a better credit score comes down to making changes in your finances. It’s not something that’s going to happen overnight, but if you make the right decisions then you can get a better credit score much sooner than you would if you were to do nothing.

Here are a few things that you can do to improve your credit score.

Make Future Payments On Time

One of the biggest marks against you on your credit score is a poor payment history. If you have shown on numerous occasions that you are prone to paying your bills late then it’s not going to look good on your credit score. If you have shown the opposite, however, then lenders can see that you can be trusted as a lender. Work out your budget to ensure that you pay things on time.

Double Check Your Report Is Accurate

Sometimes your credit score may be worse than it really is through no fault of your own. It’s very possible that there may be errors on your credit report. For instance, if someone input the wrong address when filing a credit report, it could come back to you and you’ll have a bad mark against your name. For this reason, make sure that you regularly keep an eye on your credit report to ensure that everything is correct. If there are any mistakes you can then speak to the business that made the error and request a change.

Keep Older Accounts Open

It’s always a good idea to ensure that lenders can see how well you are managing a number of different credit accounts. That’s why it’s a good idea to keep your older credit accounts open in order to demonstrate that you can do this. You will usually have an improved credit score as a result too, which is always a good bonus.

Consolidate Any Debts

If you’re struggling to juggle a few different outstanding debts, it could be a good idea to think about debt consolidation. You can usually get a loan for this and pay off multiple debts at once. This is much more manageable for many people, since you will just have one debt that you need to worry about instead of multiple. This is certainly an option that’s worth considering if you need to improve your credit score and you need to do it fast. It’s also a good idea if you aren’t very organized with paying multiple debts at once.

Conclusion

Your credit score can be something that can cause you a lot of stress sometimes, especially if your particular score isn’t very good. It can be easy to become frustrated when you’re doing everything right but your score is still taking so long to improve. Unfortunately you will need to have a little bit of patience – with time and making the right moves, your credit score is sure to improve.