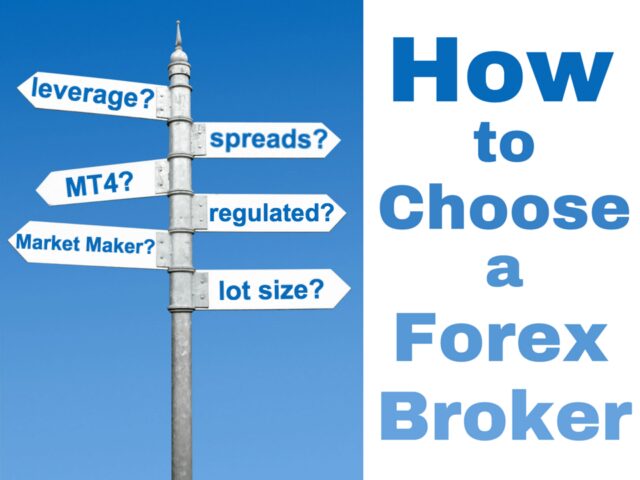

Choosing a Forex broker can be an important decision for traders and investors, as the right choice can mean the difference between success and failure in Forex trading. When selecting a broker, one should consider multiple factors such as leverage and margin, regulatory environment, costs and fees associated with trading, account types offered, customer service and support, and trading platform features.

Leverage and margin are two of the most important criteria to consider when choosing a Forex broker. Leverage is the ratio of funds that can be borrowed from a broker, while margin is the amount of money that must be deposited as collateral to open positions in Forex trading. High leverage and low margin requirements can be attractive to traders and investors, as they allow them to open larger positions with less money. However, it is important to understand the risks associated with trading on high leverage, as losses can quickly exceed deposits if trades go against the trader’s expectations.

Another factor to consider when choosing a Forex broker is the regulatory environment in which they operate. Most reputable brokers will be members of a self-regulatory organization or regulated by government agencies such as the U.S. Commodity Futures Trading Commission (CFTC). These agencies are responsible for protecting investors and maintaining market integrity, so it is important to select a broker that is compliant with applicable regulations.

How to Evaluate a Forex Broker

When evaluating a Forex broker, there are several important factors to consider. First and foremost, it is important to research the reputation of the broker and ensure that they are properly regulated. It is also important to look for competitive spreads or fees and check if their services match your trading needs.

Additionally, take into consideration the execution speed of the broker, the range of markets and products they offer, as well as customer support availability.

Finally, it is important to make sure that the broker has a secure platform with industry-standard security measures in place. By following these steps, you can be sure to choose a Forex broker that best suits your trading needs.

What to Look for in a Forex Broker

When searching for a forex broker, it is important to make sure that you are partnering with a reputable and reliable company. Before you commit to any broker, ask yourself the following questions: Does the broker have strong customer service? Do they offer competitive spreads? Is there access to trading tools and resources? Are their fees reasonable? Does the broker offer the trading platform that you prefer?

It is also important to make sure that the forex broker is a regulated and licensed provider. Check for things such as regulatory status, licensing, and any other credentials that give assurance to their credibility. Additionally, check out customer reviews from other traders and research thoroughly to ensure that your chosen broker is suitable for your trading needs.

Finally, be sure to look into the leverage options offered by the broker. Leverage increases potential profits, but it also increases risk. Make sure that you understand how much leverage is available and act responsibly with it. Forex trading can be a profitable endeavor when done correctly, so make sure you are well informed before you make any further decisions.

Taking the time to find a reputable and reliable forex broker is an important step in your trading journey. Research each option thoroughly, keeping these key points in mind, and you’ll be sure to find the right fit for your needs

The Advantages of Choosing the Right Forex Broker

Choosing the right Forex broker is essential to making successful trades and profitably managing currency markets. A good Forex broker will have excellent customer service and provide a range of tools, resources, and features to ease trading. They should also offer competitive spreads, tight margins, and reliable execution speeds. Furthermore, they should have a deep understanding and experience in the Forex markets, understand the complexities of market conditions and be able to provide advice based on their expertise.

Here are some advantages of choosing a reliable Forex broker:

1. Professional guidance: A good Forex broker will offer experienced, professional guidance when it comes to trading and navigating the currency markets. They can advise on the best strategies, and risk management plans and provide insight into the current market environment.

2. Low fees: When it comes to Forex trading, traders are looking for low spreads and low commissions. A good Forex broker will offer competitive fees so that traders can maximize their profits without having to worry about high costs associated with trading.

3. Security: When it comes to handling financial transactions, security is paramount. A good Forex broker should have robust security measures in place to ensure the safety of their clients’ funds and personal information.

4. Reliable execution speeds: The speed at which trades are executed is critical when it comes to Forex trading. A reliable Forex broker should be able to provide quick and efficient execution speeds so that traders can take advantage of market opportunities as they occur.

5. Advanced tools and features: A good Forex broker will offer a wide range of advanced tools, resources, and features designed to make trading easier and more profitable.

We were inspired by the article on europeanbusinessreview.com when we made this research.