Banks made an excellent move when introducing credit cards for use. This has led to increased consumption, allowing credit card owners to buy and use banks’ money which they can pay back to the bank in the agreed period of time. Banks, on the other hand, have profited from interest, since all loaned money had an interest rate. Even though there is an interest, and users will pay a bit more than they have taken, which will lead to bank profit. Additionally, banks can pose as acquirers or issuers, so what are the differences between these two?

Acquirer

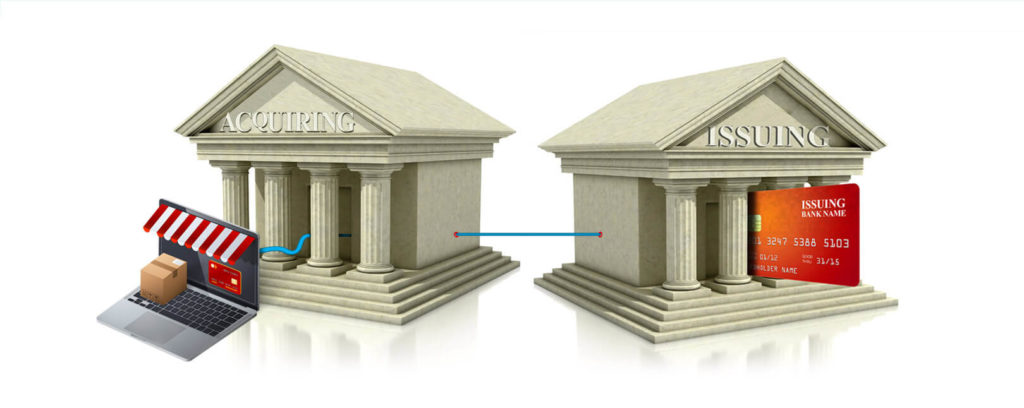

So, what is an acquirer? Acquirer or acquiring a bank will be a bank that has a job in making sure that transactions on the credit cards are running smoothly. This means that at the very moment you are taking out your credit card and it’s being placed into the machine to make the purchase the terminal calls upon the acquirer in order for it to release a sufficient amount of money from the bank that issued the card. Let’s simplify it a bit more, once you are ought to buy something with a credit card, you are asking your bank to give you the money you don’t physically have and transfer them onto your account. This transfer is being enabled by the acquirer and funds are being sent from the issuer of the credit card. Online wallets, on the other hand, have a way of doing the mentioned thing just without going to the shop and sliding your credit card through the credit card terminal.

Every store that has a possibility of credit card payments possesses a terminal that is used for communication with the bank. With every usage of the card, there is an exchange of money with different issuers. At the end of the working day, the net balance of all transactions is being sent to the acquirer and they pay up the sum of money that was asked from the bank during that day. This sum of money is reduced by the amount needed to pay for the standard fees and any reversals. By doing so the issuer is in positive profit since a bit less money has been paid to the merchant.

The way that the acquiring bank works are that they pose as a middle man and charge the user for usage fees. This is also important because acquirers also pay fees to the issuers; in most cases, they will just take those fees and transfer them to the merchants in order to lower down the amount of money loss.

As new systems develop, a lot of companies are providing services for both issuers and acquirers and therefore enable new light on payments and money transactions; HPS Wordlwide provides services to the customers whether they are issuers or acquirers in order to facilitate the whole payment process.

Issuer

Issuers on the other hand as the name suggest is an issuing bank that issues credit cards to the users. So the bank that has provided you with your current Visa, MasterCard or American Express is an issuer and has served as a link between the user and card network in case of Visa and MasterCard of the pose as their own issuer in case of American express.

The process is very similar, the user comes to the bank, it presents them with the inflow of the money on their account and the issuer then checks the possible limit on the credit card in reference to the possible payback. Once the limit is set, the user can use the credit card to buy goods and pay back the money to the issuer at the rate they have agreed on. In most cases, the money loaned is being paid back in the form of installments and there is a specific interest rate or fee that is added onto the amount of money that is being withheld. Some cardholders will charge fees even if the user is not using the credit card as standard maintenance of the account.

Once you are in the store and want to use a card, from the very moment the card has been placed into the card machine the terminal makes communication with the issuer and then the communication continues in such way that the sellers acquirer is being contacted and the transaction occurs; the money has been at this moment transferred to the acquirer. The acquirer, later on, communicates with the seller and replaces the asked sum of money that has been lowered for the amount needed for fees and other charges that are agreed between them.

If there is a problem in the transactions and that there are more funds drawn from the card than I should be, the issuer is the one that needs to be contacted. They are the ones that can put in motion specific protocols to check the validity of the claim. If the claim is true, and error has occurred, the so-called chargeback is sent to the acquirer. The acquirer then contacts the seller and he can accept or decline the chargeback. If declined the explanation is sent to the issuer and the issuer contacts the user with a proof of the decision, if accepted, funds are being returned to the user fully.

Conclusion

In the world of finances and banks, there is a very sophisticated system that is synced in order for everything to work as smoothly as possible. Each bank has its role in the system and works hard to maintain a high level of productivity. Even though it seems simple, when you dive into it you will see that there is a complex network of banks that are being called up every time a credit card is being used. Issuers provide users with credit cards and limit their assets and the number of funds they can use. On the other hand, acquirers have a job to communicate back and forward between the issuer and merchant in order for the transaction to be successful.