After weeks of linear functions, quadratic functions, and matrices, I needed an introductory example for piecewise functions. Examples like this catch student’s attention and get them thinking about how math might be used in real life. I used the example below in class and in the form you see below for my online classes.

How many of you have a car? How many of you have car insurance? In most of my classes, almost every student has a car and insurance. Yet many people are completely unfamiliar with how their insurance works and what they pay annually for that insurance.

For most people, the most important part of their insurance is the premium they pay every six months. A typical premium is $600 every 6 months. This premium may vary depending on the deductible amount. The deductible is the amount you must for a claim before the insurance company pays the rest of the claim. A higher deductible typically means a lower premium. Comparatively speaking, a lower deductible means a higher premium.

Let’s look at a possible model for the total annual cost of car insurance as a function of the amount of claims. Let’s assume the premium is $600 for every six months and that a maximum of one claim will be made annually. This particular insurance plan has a deductible of $1000. To start the function, let’s visualize how the total annual cost will change as the amount of a claim increases.

If no claims are made during the year, the total annual cost of insurance will be $1200. These are the two premium payments for the year. We’ll represent this correspondence with the point (0, 1200).

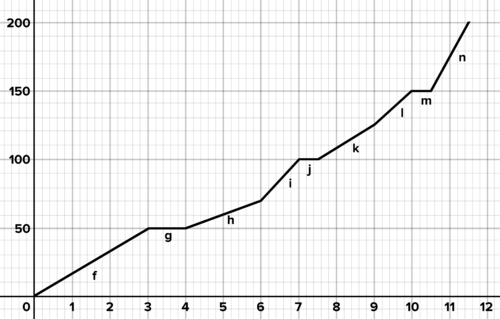

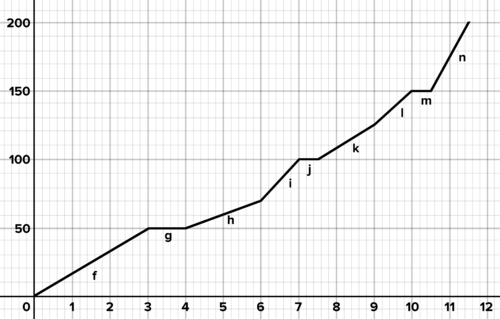

For any claims that are $1000 or less, the insured party pays the entire claim since the deductible has not been met. For instance, a claim of $500 corresponds to a total annual cost of $1700 and a claim of $1000 corresponds to a total annual cost of $2200. Let’s add this information to the graph.

Once the deductible is met at $1000, the insurer covers any additional amounts. For instance, a $3000 claim would correspond to a total annual cost of $2200 ($1200 + $1000). Adding this to our graph give the graph below.

Examining the graph, you can recognize that the there are two pieces to the graph. Since each piece is a line, this type of function is called a piecewise linear function. To find the formula for this function, we need to find the equation of each piece.

The first section extends from $0 to $1000 in claims. To find the equation of this line, we need to find the slope and vertical intercept of the line.

The intercept is 1200. In this section, all claims are paid by the insured party. So an increase of $100 in claims would lead to an increase in total annual cost of $100. The slope of this section is 1. If x represents the amount of the claim in dollars, the total annual cost in this section is

Notice that we include a description of where the section is valid to the right of the formula. This helps us to realize that this formula works for only certain values of x.

The second section is a horizontal line at a height of 2200. The total annual cost for this section is

We combine these two formulas together in a piecewise function to yield

To use this model, we must identify the section where the input falls. For instance, to compute C(750) we must note that the input of 750 corresponds to the first section. This means the cost is calculated from the first part of the function,

This means a claim of $750 would give a total annual cost of $1950.

Other piecewise function are used in a similar manner. Identify the section which the input falls in and then put the input into the formula for that piece.

With this introduction in place, I have students construct their own cost functions using their own insurance policies or ones that I supply. I like to have them work on the board to do this where they can ask each other questions and correct mistakes.