Investing is one of the most important financial decisions you’ll make. After all, money invested will grow and produce income over time. The risks are also very high, so investing wisely requires a balanced perspective and a lot of due diligence. To build a successful portfolio of investments, you need disciplined financial planning and an ethical approach to your investments.

Investing ethically involves researching companies to understand their business model, management team, and long-term prospects. It’s not enough to invest in companies that are profitable; you should also invest in companies that can generate positive cash flows in the long term.

With an ethical investment strategy, you’ll identify companies with strong social responsibility practices and avoid those with poor track records or questionable business models. It’s not as complicated as it seems—and it can be rewarding too!

Let us break down the meaning of ethical investing so you can get an idea of how ethical-minded investors make the most out of this concept.

What Is Ethical Investing?

Investing is about putting your money to work for you, so you should be confident that the companies you choose to invest in are good bets for long-term returns. But ethical investing is caring about more than just profit.

Ethical investors choose their stocks and funds based on the company’s social responsibility and impact, as well as its financial strength. This means avoiding investments in companies that have poor social responsibility practices, like those with violated labor laws, human rights violations, or environmental pollution.

With ethical investing, you can have your cake and eat it too! These investments offer strong earnings growth, consistent growth in dividends, and a positive, long-term competitive advantage. You can achieve this all while making the world a better place for all humanity.

Why Is Ethical Investing Important?

Ethical investing is important because it allows you to support worthy causes and promote positive social change. You can invest your money in ways that align with your values. For example, you can invest in companies that support environmental sustainability or human rights issues.

Ethical investing can also make good financial sense. Companies that have a positive social impact tend to have lower risks and higher returns compared to their non-ethical counterparts.

Ethical investing can also help you diversify your portfolio and protect your assets from financial risks. That’s because ethical companies happen to be less volatile because their business models are more predictable.

Keep in mind that investing in too few stocks or funds can expose you to greater risk. Ethical investors generally aim to have a broad portfolio with a mix of stocks and funds based on company size, industry sector, and geographic regions.

Ethical companies also tend to have a competitive advantage, which means they’re less likely to be overtaken by their competitors. These companies can often adapt to change more easily and thrive in the long run.

How to Build an Ethical Portfolio

While there is no perfect formula for picking out ethical investments, there are certain strategies you can follow to make the process more manageable. An ethical investor’s selection criteria will be based on both company-specific factors and macroeconomic factors.

So, how do you know which factors to consider?

The first step is to identify your investment strategy. Are you looking to build a large, passive equity portfolio that includes a wide range of investments, or is your investment strategy more focused on specific investment strategies?

Now that you have your strategy figured out, the next step is to identify your investment goals. Investment goals can range from long-term preservation of capital to specific investment strategies, like growth or income.

Once you know what you’re trying to achieve, the next step is to identify your desired risk/reward profile. Are you looking for high certainty, or are you willing to take on some degree of risk for the potential for big returns?

Next, you’ll want to identify companies with strong social responsibility practices and avoid those with poor track records or questionable business models. You can find these companies through stock screening tools or investment advisories from companies.

You can also do your own research. Ethical investing, after all, is about due diligence, so read up on a company’s business model, financial results, and management team. Make sure that the company generates positive cash flows and operates in an industry with sustainable demand.

Key Principles of Ethical Investing

Invest With Integrity

Maintaining a high level of integrity while investing is crucial to ethical investing. Investors should put their money towards causes they believe in and avoid supporting companies that have inherent social problems.

Accountability Is Key

Companies with strong social responsibility practices demonstrate a dedication to being a positive force in the world. These companies should be held to higher standards and should be better managed than the average company.

Set Realistic Expectations

Many investors aspire to a high level of investment return, but this is often unrealistic. Investors should aim to achieve a level of return that is commensurate with the risk they’re taking.

Keep in mind that ethical investments can take a long time to achieve financial goals. So try to be patient and think long-term on your wealth-building journey.

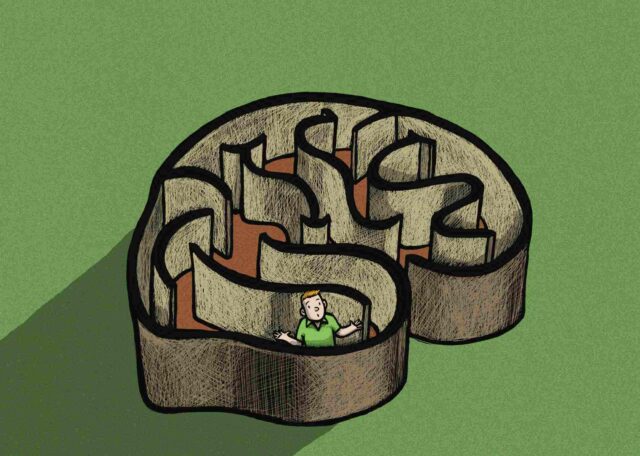

Try Not to Make Rushed Decisions

Investing should not be rushed. Instead, they should be analyzed carefully and made only after a thorough review of the company’s track record and financial health.

Just because a certain company is trading at a certain high or low price doesn’t mean you should jump in and buy at either. Try to consider the company’s track record, management team, and long-term prospects before making an investment decision.

In Conclusion

There’s no one-size-fits-all approach to ethical investing. You’ll need to examine your financial situation and decide how to invest ethically based on your unique circumstances.

To achieve positive long-term returns, you’ll need to make well-researched decisions and avoid knee-jerk emotional investing. You must also learn how to identify strong companies with positive long-term prospects by studying market trends, economic data, and company fundamentals.

Remember to monitor your investments regularly so you can identify potential risks and re-evaluate your investment strategy from time to time.

With the right approach, it’s possible to make a lot of money and a positive difference in the world.