Stock trading is one of the best ways to earn money these days. Many people are earning money by investing in stocks. You can earn a good profit by investing in different types of stocks. Investing in stocks is also risky, especially if you invest in beta stocks. So if you can face high risks then you can invest in high-growth stocks. There is no doubt that they provide high rewards, But there is also the risk of losing your money instantly.

Understanding the role of these stocks and their applications could be crucial for investors looking to grow their portfolios and determine the most profitable stocks in the overall stock market. In this article, we look at some of the good stocks in the market with the best returns. Although past performance is not an indicator of future results, these stocks have been shown to outperform the S&P 500’s one-year annual performance.

Beta Stocks and Risk

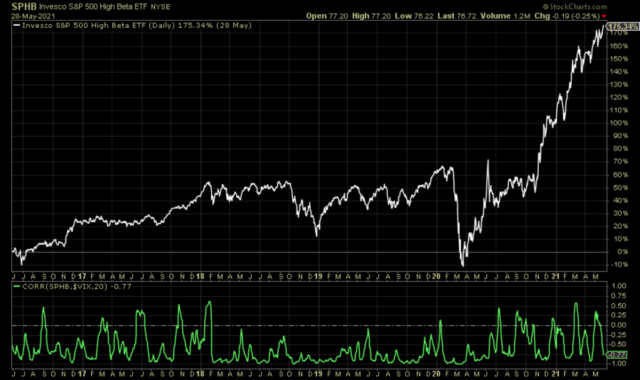

There are many risks associated with these stocks. The term Beta is used to measure the volatility of the price value of the company with the other competitor companies. Where it is interpreted as a signal of risk. The beta of a stock is calculated using a regression analysis that determines the relationship of the price movements of the stock to that of the S&P 500. Therefore, a beta value of 1.0 means that the volatility of a stock is similar to that of the stock. market and therefore likely to be in sync with the index at similar rates.

This indicates more than one indicates the company’s volatility in the market. A point of less than 1.0 means less volatility. buyshares.co.uk is one of the beta stocks in the market. The degree of volatility is usually a sign of risk. Higher numbers indicate greater risk, while low numbers are associated with less risk. Therefore, stocks with higher points may arise in the high market but lose more in the bear markets.

These Stocks can be Best Investment

Choosing a good stock is very important for good returns and reasonable profits. These stocks are a very good investment because they provide good returns. However, they require proactive management due to their sensitivity to the market. They can be extremely volatile investments and therefore very risky when not in a group. Therefore, in the event of a bear market reversal, it can be predicted that these stocks will suffer the most.

Some Examples of High Beta Stocks

There are many examples available in the market. If we look at three stocks from the previous years that are an example of historical stocks that have betas about 2.5 and that was part of the S&P 500 index. You should keep in mind that these historical examples are only for informational purposes to provide insight into the way high beta stocks behave and are not intended to be investment guidance only.

SVB Financial Group (SIVB)

SVB Financial Group is one of the big companies which owns and operates Silicon Valley Bank, serving clients in the Napa Valley region of California. According to the company’s website, Silicon Valley Bank has helped finance more than 30,000 startups.3 SVB is listed as the largest bank in the United States.4 It is also among the top service providers for winemakers in Napa. Valley. Due to its small market and riskier clientele, SVB’s shares had a beta of 2.25

Advanced Micro Devices (AMD)

AMD is a semiconductor business that manufactures microchips and chipsets that compete with other companies such as Intel or Qualcomm. AMD’s shares increased by more than a third in value. The market cap of AMD as of June 2025 was $53 billion. Despite its upswing, the company was still riskier than the majority of S&P 500 stocks, having an alpha of 2.12.

United Rentals, Inc. (URI)

It is one of the leading companies in the stock market and the world’s largest equipment rental company, serving customers primarily in the United States and Canada. Established in 1997, URI currently has more than 700,000 pieces available for rent, which is equivalent to more than $ 15 billion.67 But, the business is in a highly volatile and commercialized sector and is heavily affected by minor fluctuations in the demand that can result due to contractions.

Final Words

You need to be active and get good knowledge from the stock investment and trading and for getting good performance from beta stocks. If you do not know much about stocks try to learn about them there are many online sources where you can learn about stocks and beta stocks. There are many online platforms that provide free educational stuff to their users and subscribers. Most of this type of platform did not charge anything extra.

You can learn a lot from these educational materials that contain videos and ebooks. The social media platform is also a good place to learn about stocks and funds. There are many groups and pages about stock trading where experts and professionals share their experience and knowledge with other investors and traders.

These stocks are typically small and mid-cap stocks with maturity, with substantial fluctuations around announcements. All three stocks listed are in the small-cap category and both Largo and California Resources are moving toward the mid-cap range. Each has its own growth catalysts that have helped you increase your profits.

Remember that investing in high-growth stocks, high beta stocks are also risky, so it is essential to be aware of these investments and try to make them more balanced with lower risk portfolios and cash to fund liquidity. Always play on the safe side, never put all your money in one stock, you should follow the rule of not putting all eggs in a basket.

This will help you to survive if the market goes against you due to any bad news or reason.