Proof of income might not be something you think about often, but it plays a crucial role in many aspects of life. You have the correct documentation, from renting an apartment to applying for a loan. Discover how work paystubs can be a valuable tool for proving income in this guide, and find effective ways to use them.

Understanding Proof of Income

Proof of income is a way to show that you earn money regularly. You may need it in different scenarios, like renting a place, applying for a loan, or going through immigration processes. Leveraging work paystubs for proof of income can open doors and make life easier. Proper proof of payment is crucial in demonstrating financial stability and reliability in these scenarios.

The Role of Work Paystubs

Work paystubs are one of the most common and reliable forms of proof of income. Paystubs, handed out by your employer with every paycheck, detail your earnings, itemize deductions, and indicate the amount you pocket after factoring in taxes and other deductions.

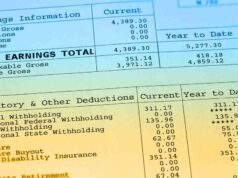

Components of A Typical Work Paystub

Let’s break down what you’ll typically find on a paystub:

Gross Income

Calculate your gross income by adding the total amount you earn from your job or business without subtracting taxes, insurance, or other expenses. Think of it as the big picture of your earnings before factoring in any deductions.

Deductions

Deductions are the specific amounts taken out of your paycheck to cover various expenses such as taxes, insurance premiums, and contributions to your retirement savings. You allocate these portions of your gross income before receiving your final pay.

Net Income

Your net income is the money you bring home after deducting all the essential expenses from your gross income. It reflects what’s left to spend or save, providing a clear picture of your earnings once all the financial adjustments have been accounted for.

Why Work Paystubs Matter

Paystubs are essential because they serve several crucial purposes for employees and employers.

Earnings Record

Paystubs provide a detailed record of your earnings. Check out your payments for a specific pay period, highlighting the amount you’ve made before any deductions or taxes get subtracted.

Deductions

Paystubs detail the deductions from your earnings, providing a comprehensive list of the amounts withheld. These deductions may include taxes (like income tax and Social Security), insurance premiums, retirement contributions, and other withholdings.

Contributions

If you’re making contributions to retirement accounts or other savings plans through your employer, your paystub will reflect these contributions. It helps you keep track of your savings progress.

Financial Planning

You can plan your finances effectively with the information on your pay stub. You can budget your expenses based on your net pay after deductions, and you’ll have a clear picture of how much money goes into savings or retirement accounts.

Proof of Income

Paystubs can also prove income when applying for loans, rental agreements, or government benefits. They demonstrate your earning history and financial stability.

Using Work Paystubs Effectively

Here’s how to use your paystubs the right way:

Budgeting and Financial Planning

A paystub serves as a helpful tool for creating a practical budget. Detailing your earnings and deductions provides a clear picture of your financial situation, enabling you to manage your money wisely.

Applying for Rental Properties

When seeking a rental, landlords often request proof of income to ensure you can meet rent obligations. Your paystubs serve as tangible evidence, reassuring landlords about your financial stability and making the rental application process smoother.

Applying for Loans and Credit

Lenders require assurance of a stable income before approving loans or credit cards. Sharing your paystubs with them establishes trust by showcasing your regular earnings, increasing the likelihood of successful loan applications.

Tax Filing and Compliance

Paystubs play a crucial role in accurate tax reporting. They provide essential information about your income, facilitating compliance with tax laws when filing returns. Having organized paystubs ensures a smooth and error-free tax filing process.

Verifying the Authenticity of Paystubs

Verifying the authenticity of paystubs is essential to avoid falling victim to fraudulent documents. Here are some steps you can take to ensure the legitimacy of a paystub:

Cross-check with Bank Statements

Compare the details on the paystub, such as the amount, deductions, and pay dates, with your bank statements. It could indicate a fake pay stub if they don’t match.

Check Employer’s Contact Information

Ensure that your employer’s contact information on the pay stub is accurate. It includes the company name, address, and phone number. It could raise suspicions if you need to fix or align these details with your records.

Report Discrepancies

If you need more clarification or have doubts about the paystub’s authenticity, report them immediately. Contact your employer’s HR department or the relevant authorities, such as the labor department or law enforcement, to investigate further.

Common Mistakes to Avoid when Dealing with Paystubs

Falsifying Paystubs

If you fake paystubs, inflate income, or add fake deductions, you may face legal consequences, such as fines or imprisonment. Provide accurate information to maintain trust and comply with the law.

Failure to Keep Copies

Keep copies of paystubs as proof of income for loans, rentals, and taxes. A lack of records can hinder financial opportunities and create complications.

Misunderstanding Paystub Components

Understand gross income, deductions, and net pay to avoid budgeting errors. Misinterpreting elements may lead to overspending or inadequate savings. Thoroughly comprehend your pay stub for informed financial decisions.

What Should I Do if I Can’t Get My Work Pay Stubs from My Employer?

If you need help getting your paystubs, contact your HR or payroll department, inquire about an online portal, check employment materials for guidance, and maintain a professional approach in your communication.

Can I Use My Pay Stubs to Apply for Government Assistance Programs?

Certainly! You can use your paystubs to demonstrate your income when applying for government assistance programs such as food stamps or housing support. They are a straightforward way to showcase your financial situation and support your application. They help the government understand your financial situation.

Conclusion

Mastering proof of income with work paystubs is crucial for financial management. Whether renting, applying for a loan, or tracking earnings, paystubs offer a clear financial snapshot. Keep them safe, use them for budgeting, and ensure a smoother financial journey toward your goals. Your paystubs are reliable companions in this adventure.