When it relates to obtaining a new card, the incentives people pay attention to are commonly limited to the earn rates, welcome bonuses, and operational charges for the service. They hardly ever take into account where they are going to get that card from. Depending on what payment card issuer you cooperate with, the suite of available advantages will differ. It is also a matter of your financial prestige, convenience, and security in self-management and relations with customers.

In today’s digital age, payment cards have become an integral part of our financial lives. We use them for everyday transactions, online shopping, and even as a means of building credit. Behind these plastic cards, there are entities known as payment card issuers that play a crucial role in making our financial interactions seamless. In this guest post, we will delve into the world of payment card issuers, exploring their definition, role, the distinction between credit card networks and issuers, and the mobile apps they offer.

The status of your card-issuing partner is important and has a significant impact on where and how the received cards (and, therefore, transactions) will be accepted. Stay tuned to understand the basics behind a high-end card issuer’s work and what benefits to strive for when choosing one. Onwards!

Payment Card Issuer Definition

It is an umbrella term for financial institutions that provide tools to proceed with operations for end users, namely, different types of credit and debit cards. Such facilities are associated with but not limited to banks.

There are several independent third parties with convenient service conditions for your business, which back you up with high-end financial technologies for your physical and virtual accounts. In turn, cards obtained from these issuers are highly customized and personalized — you can include your contact information, business name, and so on.

A payment card issuer, in essence, is a financial institution or organization responsible for providing payment cards to individuals or businesses. These cards can come in various forms, including credit cards, debit cards, prepaid cards, and more. Payment card issuers are the entities that issue you your credit card when you apply for one.

To put it simply, when you apply for a credit card, the bank or financial institution that approves your application becomes the issuer of your card. They are the ones who decide your credit limit, annual fees, interest rates, and other terms and conditions associated with the card.

The Role of Payment Card Issuers

There are numerous different organizations like card issuers, banks, and networks that contribute to the quality of payment procedures and the financial ecosystem in general. If you strive for more efficient transactions, understanding what a chosen service provider means and how it works will obviously be contributional. This knowledge leads to more sufficient decisions in the market, letting you build credible long-term relations with a card issuer, satisfy your goals in terms of payment performance, and reduce the related processing fees.

Payment card issuers play a pivotal role in the world of finance. Here are some key functions they perform:

- Card Issuing: As the name suggests, their primary function is to issue payment cards to consumers and businesses. They evaluate your creditworthiness and determine the terms of your card.

- Risk Management: Payment card issuers assess the risk associated with lending money through credit cards. They use various criteria to determine your creditworthiness, including your credit score, income, and financial history.

- Transaction Processing: Once you have a payment card, the issuer is responsible for processing your transactions. This involves authorizing purchases, handling payments, and ensuring that your transactions are secure.

- Customer Service: Payment card issuers provide customer support to cardholders. This includes addressing inquiries, resolving disputes, and assisting with issues related to card usage.

- Statement Generation: Issuers generate monthly statements that detail your transactions, outstanding balances, and payment due dates. These statements are crucial for managing your finances.

Credit Card Network Versus Payment Card Issuer

As often happens in the market, there are times when certain terms seem similar — synonymous and interchangeable. In practice though, this is a beginner mistake for organizations lacking financial literacy. The more you take a deeper insight into the topic, the more you will realize how to distinguish a perfect match offer for your needs.

When it comes to payment card issuers and networks, you shouldn’t confuse them. While networks are there to create an environment, where transactions are feasible, companies that offer cards provide tools to operate within the created system. The list of networks includes such major domains as American Express, Visa, and Mastercard. In turn, online banking institutions serve as a sample of popular payment card issuers.

It’s important to distinguish between a credit card network and a payment card issuer. While they both play a role in the credit card ecosystem, their functions are different:

- Credit Card Network: Credit card networks like Visa, MasterCard, and American Express are responsible for setting the global standards for payment cards. They facilitate transactions between merchants, cardholders, and issuers. They do not issue cards directly but provide the infrastructure for card transactions to occur.

- Payment Card Issuer: As mentioned earlier, payment card issuers are the institutions that issue the actual credit cards. They determine the terms and conditions of the card and manage the relationship with the cardholder.

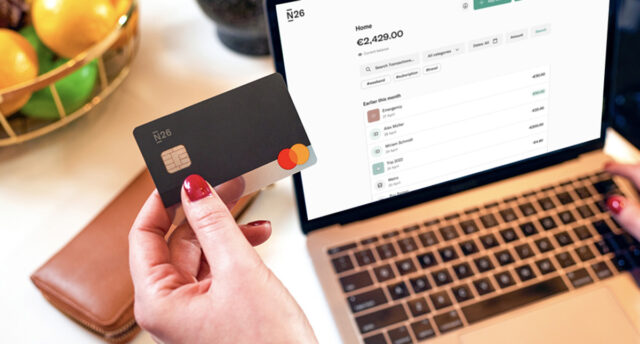

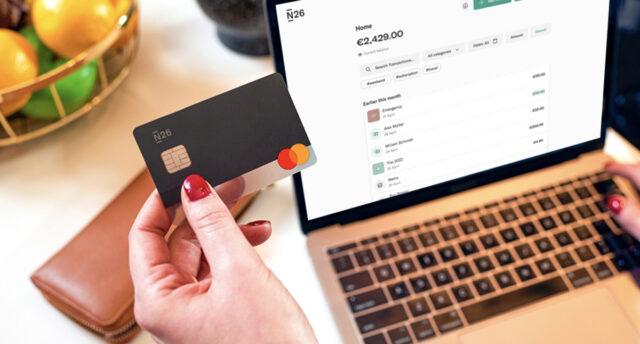

Mobile Apps from Payment Card Issuers

The advancement in modern technologies expands the versatility and flexibility limits for businesses. To maintain solid and trust-based relations with your audience, it is also necessary to deliver easy-to-reach and fast-to-customize payment solutions to them. With the help of services, you don’t only get the advantages of a credible card issuer. At the same time, you can use physical and virtual credit or debit cards to make more convenient and instant transactions.

In today’s fast-paced world, mobile apps have become a game-changer in the financial sector. Many payment card issuers offer mobile apps to enhance the cardholder experience. These apps provide a range of features and benefits:

- Account Management: Mobile apps allow cardholders to manage their accounts on the go. You can check your balance, view transactions, and make payments directly from your smartphone.

- Security: Most mobile apps from trusted payment card issuers incorporate advanced security features. These include biometric authentication, transaction alerts, and the ability to lock or block your card in case it’s lost or stolen.

- Rewards and Offers: Some apps provide access to exclusive rewards, discounts, and offers for cardholders. You can easily track and redeem rewards through the app.

- Notifications: Stay informed about your account activity through push notifications. You’ll receive alerts for large transactions, due dates, and more.

- Digital Wallet Integration: Many mobile apps allow you to add your payment card to digital wallets like Apple Pay or Google Pay, making contactless payments a breeze.

The mobile system provides an opportunity to sign in in with an email address, phone number, or other chosen authentication methods. This approach is appreciated for its comfort and simplicity, which also speeds up the banking platform’s operation. With a mobile app from a payment card issuer, you can monitor your transactions within one intuitive and multifunctional interface. It also comes with a high-end notification system, letting you stay ahead of your performance.

Final Thoughts

Becoming a cardholder of the best issuers in the market is surely advantageous from many perspectives, presenting you with a wide range of rewards, transaction tracking, credit reporting, and fraud prevention means. The service utilizes system to obtain a multifunctional card with a trustworthy backup of your business financial cycle — accessible via a mobile app, caters to the latest ani-laundering requirements, and comes with KYC verification.

In the world of modern finance, payment card issuers are the cornerstone of our financial transactions. They enable us to make purchases, build credit, and manage our finances effectively. Understanding their role and the services they offer can help you make informed choices when it comes to your payment cards. In today’s digital world, having a mobile app from a trusted payment card issuer can make managing your finances more convenient and secure.

In conclusion, payment card issuers form the backbone of the modern financial landscape, enabling individuals and businesses to access the benefits and convenience of payment cards. Understanding their role and the services they provide is crucial for making informed financial decisions.

Mobile apps from trusted payment card issuers have further revolutionized how we interact with these payment cards. These apps enhance security, provide easy account management, and offer exciting rewards and discounts, making financial transactions smoother and more efficient.