Trading strategies are aimed at giving a trader the maximum amount of profit and minimizing losses in the process of selling and purchasing stocks. Of late, cryptos like bitcoin and litecoin have become popular items in the trade market.

In recent years the trade market for the cryptos has become quite deep as more and more investors have begun to see the worth and the potential of these currencies. So if you want to get expert advice on formulating a trade policy for cryptos like bitcoin, you can go to https://immediate-edge.live/.

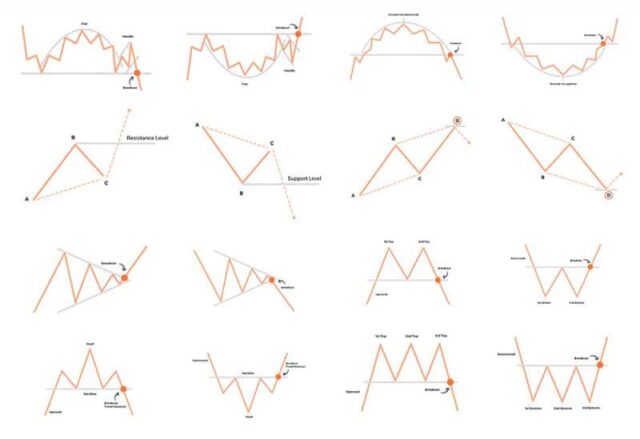

What Are Some Common Trading Patterns That Traders Often Follow

Some day traders follow a strategy known as rallying. In this case, they buy and sell a stock or a crypto if its price rises in a sustained manner for a long period of time. There is another common day trading strategy known as scalping. In this strategy, a person’s aim is to make profits by registering small gains.

Here a person undertakes many transactions a day to make marginal profits multiple times so that he registers a net gain. So in scalping, a person prioritizes the volume of trade over the value of each individual share or crypto.

How Can You Make A Profit By Using Scalping Strategy

Trading Based On Stochastic Values

In this strategy, a person buys or sells based on the current price of a stock or crypto in relation to its price range over an extended period of time, like a week or a month. The oscillation or the movement of the price of crypto in relation to its previous price range is an indicator of the market trend.

If the trend is such that the price is moving up in a steady manner, then the trader will postpone the sale of his cryptos as he will get a higher price for his assets at a later date. However, if the trend is such that the price of crypto is decreasing in a steady manner, then the trader might sell immediately to minimize his losses.

Trading Based On Moving Average Values

This method gives a constantly updated trend of price movements. Usually, the average for one long term period and two short term periods are used to get an idea of the trend. Again, depending upon whether the trend is showing a propensity to rise or fall, the trader buys or sells.

So if crypto shows a tendency to gain value in the near future, then a person can buy more at present to gain by selling them in the future. Likewise, if crypto is showing a sustained tendency to lose value, then a prudent trader can sell immediately to minimize losses.

Having An Effective Exit Plan

A person who wishes to gain by registering marginal profits has to have a solid exit strategy. Since, in scalping, a trader gains by a small margin, any huge loss can offset all the previous gains. So a solid exit strategy is a must to make sure that a person does not suffer a heavy loss.

Stock markets can be very volatile, and the value of a stock or crypto can see a lot of change within a few minutes or hours. Hence, if a day trader does not have a solid exit strategy, he stands to lose. He should have clear indicators and benchmarks for exiting the market. If any of the indices breach the tolerance levels, then the exit should be immediate.

Be Ready To Buy And Sell Multiple Times In A Day

A day trader who aims to gain out of marginal profits has to buy or sell several times such that the volume of the transactions increases manifolds. The idea beyond trading many times is that small changes that accumulate over a large volume ultimately give a sizable profit. So a scalp trader must be mentally prepared to make buying and selling decisions more than a hundred times a day.

Have The Ability To Execute Plans Quickly

If a person has to gain by means of marginal changes in price, he should have the capacity to execute decisions quickly. If a person does not have the ability to sell or buy quickly, then he might miss the most opportune moment to buy and sell. And this, in turn, may reduce his profit margins. So the ability to sell directly without the meditation of a broker or having quick access to brokers is the way to make a profit via scalping.

A Desire To Invest In Assets Whose Prices Are Volatile

A person who wants to make a profit via scalping has to invest in assets whose prices are volatile. Stocks or asset’s whole values are volatile and have price movements all through the day.

If a stock is not volatile, then its value might increase or decrease after long periods of time, like a month or even a year. These assets are of no use for day traders as there will be no appreciable change in value within a day or an hour. So investing in a volatile stock is a must if someone is to end up making a gain by buying and selling on a short term basis.

Target Specific Periods When The Market Shows A Lot Of Activity

There are specific time periods like the time when quarterly reports are filed or at the end of the financial year when there is a lot of activity going on in the market. A scalper must target these occasions as he can make a lot of profits on days when the market is bustling with activity.

Conclusion

Day traders aim to get many times in a day in order to register a net gain. Scalping is a tried and tested day trading technique. However, in order to be successful in this technique, a person must read the market well, he must be able to take quick action, and must have a solid exit plan when the situation demands.