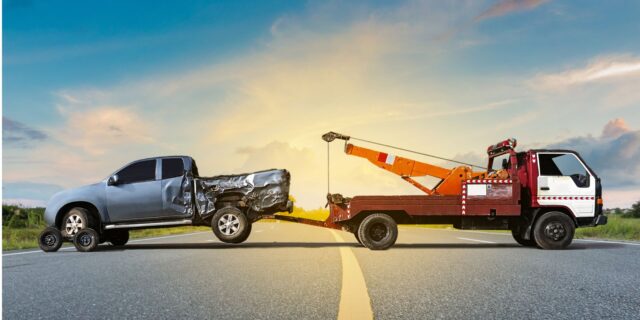

Are you a tow truck driver looking to ensure your business is adequately covered? Tow truck insurance is essential for anyone who owns or operates a tow truck, so you must understand all the necessary coverage and costs associated with getting insured.

So, if you need extra protection, keep reading to learn more about your options. We will discuss how much it costs, what factors affect this cost, why you need it, and the benefits of having it for your tow truck businesses.

How much does tow truck insurance cost?

Tow truck insurance is an essential expense for any tow truck business owner. However, the cost of insuring tow trucks depends on several factors. Typically, tow truck insurance costs are higher than regular automobile insurance.

Business owners can save money by shopping around with different insurance providers and getting quotes from several agencies. While the cost of tow truck insurance may seem high, investing in proper coverage to protect your business and assets in an accident or unforeseen event is essential.

What affects how much tow truck insurance costs?

When it comes to owning a tow truck business, several factors can affect the cost of insurance. Firstly, the location of your business can have an impact on your premium rates. Depending on the area you operate in, certain regions may be considered riskier than others and, therefore, can result in higher insurance costs.

Other factors impacting the price include the number of drivers, the type of towing services you offer, and how many trucks you own. Additionally, your driving history, hours of operation, driving radius, loss run history, and whether you cross state lines can all play a role in determining your insurance costs.

It’s also worth considering implementing a safety program, as this can positively influence your insurance rates. Therefore, it’s essential to consider all these factors and find the right insurance plan that caters to your specific needs without breaking the bank.

How does tow truck insurance work?

It can be complicated, but it’s essential for anyone in the towing business. This insurance protects you and your company if one of your vehicles is part of an accident or experiences some damage while on the job.

What’s interesting about tow truck insurance is that it typically covers various scenarios, from collisions on the road to damage that might occur while lifting a vehicle. Rates for tow truck insurance depend on a range of factors, including the size and age of your fleet, the experience of your drivers, and even the types of vehicles you’re towing.

In general, though, it’s always better to be safe than sorry, so if you’re in the towing business, ensure a reliable tow truck insurance policy covers you.

What are the legal requirements for tow truck insurance?

To comply with state laws and protect themselves from liability, it must have specific types and amounts of insurance coverage. The exact insurance requirements differ by state, but some typical coverage types that tow truck businesses may require include the following.

When operating a tow truck business, it’s essential to understand the requirements for insurance. Liability insurance is a must-have, as it covers damages or injuries that may occur while towing. Workers’ compensation insurance is also crucial for protecting your employees in case of an accident.

Additionally, garage liability insurance can protect your business in case of damage to a customer’s property while on your premises. And let’s remember on-hook towing insurance, which covers damages to vehicles you tow.

What kinds of businesses need tow truck insurance?

There are many dangers when operating a towing business, from accidents on the road to damage to the vehicles you’re towing. That’s why it’s crucial to have proper tow truck insurance.

However, it’s not just towing service providers who need it. Auto body shops, repair shops that pull customer vehicles, and roadside service vendors that assist the highways also need tow truck insurance.

In addition, those who haul vehicles to auto salvage and auction sites or operate a full-service garage should also ensure they have this coverage in place.

What does tow truck insurance cover?

Tow truck insurance covers a variety of aspects that are crucial for owners to consider. On-hook towing coverage is designed specifically for the vehicles being towed, and motor truck cargo coverage is for the goods they carry. Bodily injury and property damage liability protect the driver should an accident occur.

Garage keeper’s liability is for tow trucks parked at a garage, while wrongful repossession coverage protects the owner if someone files a claim for wrongful repossession. Adequate coverage for each aspect is essential to protect your tow truck business in an accident or incident.

What are the benefits of having tow truck insurance?

Having towing insurance can be a lifesaver in many situations. Imagine driving on the highway, and suddenly, your car starts making strange noises, eventually coming to a halt. Now, what would you do in a situation like that?

Knowing you are covered brings peace of mind and saves you from unexpected costs, including towing, storage, and other services.

With a reliable tow truck insurance plan, you will be protected in case of unforeseen car breakdowns and accidents that require towing services. So, investing in towing insurance is always a clever idea to ensure a worry-free experience on the road.

Costs, Uses & Benefits Of Tow Truck Insurance – In Conclusion

This is a crucial safety net for towing operators. Like any other business, protecting your vehicles often takes time and money. The tow truck insurance cost will depend on several factors, such as the type of insurance you need and whatever risks you want to be covered.

However, considering the extensive uses and benefits tow truck insurance provides, getting it is a worthwhile investment. Tow Truckers should be quick to contact tow truck insurance to protect their vehicles and ensure they are financially secure in case of unfortunate incidents.

Tow truckers must remember that quality tow truck insurance policies offer flexibility, coverage options tailored to meet individual needs, and other great benefits insurers provide. Start protecting your business today by obtaining proper tow truck insurance.