In 2024, the stock market entered the red zone. Exceeding “safety limits” didn’t shy away from any industry – chipmakers were no exception. But that’s history now. It’s 2024 over here, and it might be a good moment to invest in some semiconductor companies and get a profit. Taiwan Semiconductor Manufacturing Company seems to be a good game this year. At the very least, some market analysts believe it to be in a strong position. Let’s try to find out why.

But first, you need to see what was going on with the shares of semiconductor manufacturers throughout 2024. It will help you appreciate the scale of the problem. Qualcomm, TSM, Micron, Intel, AMD – all these giants here demonstrate a synchronized fall into the abyss.

A weighty conclusion one might reach while looking at the chart is that TSM stock movements go together with general market movements. Meaning that the fall is connected — in the first place – not (only) with the company itself, its internal and external issues, but with global affairs.

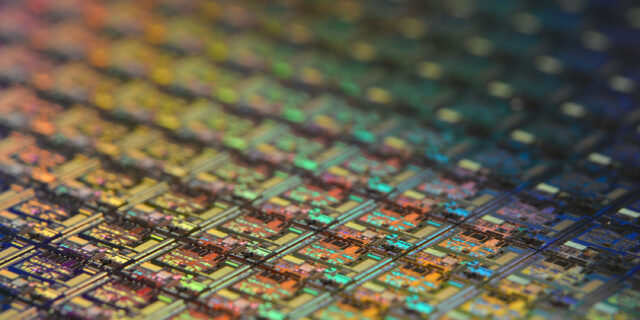

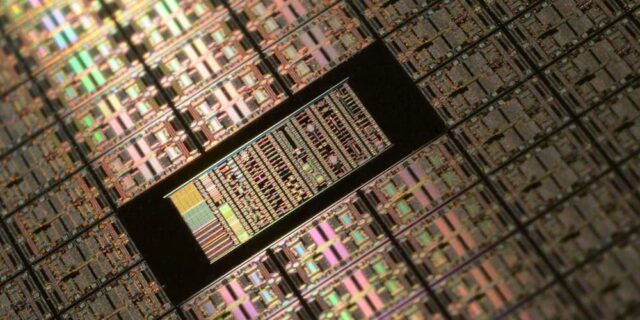

At the same time, Taiwan Semiconductor Manufacturing Company has a special role in the semiconductor industry. It’s the biggest contract chipmaker in the world, with a 50% share of the global semiconductor foundry market.

And if that wasn’t enough, it’s also the main chip supplier for Apple and its new iPhones supporting 5G. Hopefully, now you can see the significance of this figure. These facts also allow us to add Taiwan Semiconductor Manufacturing Company to the list of 5G stocks.

The cooperation between TSM and Apple has been on everyone’s lips for years. Apple is shifting towards a strong partnership with TSM willing to keep its reliance on Qualcomm to a minimum with plans to have the Taiwanese chip titan make 5G iPhone modems from 2024.

The idea is to adopt TSMC’s chip production technology to mass produce its first in-house 5G modem chip. Besides, Apple is developing its radio frequency, millimeter wave components, and power management chip for modems. Currently, these components are provided by Qualcomm.

This “struggle for independence” may yield some dividends shortly. Not for Qualcomm, of course. The company was ready to lose about 20% of modem orders needed for iPhones. At least this is what they confirmed last year, but it sounds like Qualcomm may be producing chips for Apple for at least another two iPhone generations.

According to some sources, Apple’s own iPhone 5G modem chip development might have failed, so Qualcomm will remain the exclusive supplier for 5G chips of 2H23 new iPhones, with a 100% supply share. They still expect that Apple will continue to develop its own 5G chips, but it will take more time for the work to be completed and satisfactory for use in iPhones and other devices.

Qualcomm, which has been prevailing in this field, is not ready to follow Intel’s (which supplied modem chips to Apple alongside Qualcomm) steps and sell the business to Apple.

Apple had a protracted legal battle with Qualcomm and planned to use Intel 5G chips in the 2020 iPhones, but that ultimately was not possible as Intel was not able to manufacture 5G chips that met Apple’s standards. These modem chips are vital components, as call quality and data transmission speed depend on them.

Apple ended up settling its lawsuit with Qualcomm in 2019. The settlement included a payment from Apple to Qualcomm. The companies also reached a six-year license agreement, effective as of April 1, 2019, including a two-year option to extend, and a multiyear chipset supply agreement. Since then, has used Qualcomm 5G modems in the iPhone and iPad lineups.

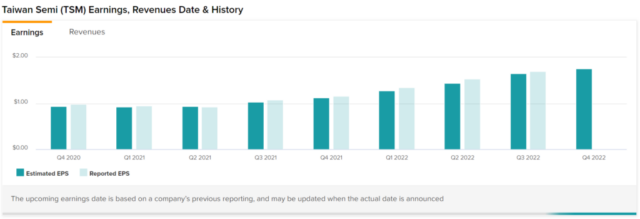

The economic performance TSM delivered at the end of Q3 2024 was impressive. The third-quarter revenue growth amounted to 35% year over year – $20.23 billion in comparison with the $19.91 billion consensus.

Moreover, the margin results were even more outstanding. The Q3 gross profit margin increased to 60%, and the Q3 operating profit margin to 50%. In addition, the company managed to achieve these numbers at a time when smartphone sales are decreasing.

Sounds like a real goldmine, doesn’t it? Well, try to take those rose-colored glasses off when analyzing these results – the performance is great, but the overall market situation and the world economy remain unstable. So, don’t let the stats enchant you – remember to be rational.

Also, try to expand the boundaries and take a look at the big picture. TSM stock might be a good choice for a long-term investment. Chips are used in the production of all possible devices – they are the brains of smartphones, cars, drones, space vehicles, computers, etc.

In tough times, demand decreases (which is understandable) – and the resumption of demand is a powerful growth driver. Demand for 5G phone chips is booming at smartphone vendors right now. Mobile customers are buying lots and lots of leading-edge 5G chips.

However, the anticipated demand may lead to high inventory levels. If the customers keep over-booking chips, it may be followed by sharp inventory correction. But TSM isn’t worried about an inventory correction because the market for 5G is sure to grow over the next couple of years, meaning everyone will need the chips.

And guess what – they owe to the Covid-19 pandemic, as it has been accelerating the digital transformation and creating a lot of new demand. Even right now is that they expect inventory to be higher than historically high levels, but the demand will pick up.

Another factor in favor of TSM is that the company plans to kick-start mass production of its next-generation 3-nanometer chips – it’s an additional nitro charge for its engines, in the semiconductor race. Besides, TSM is in talks to build chip plants in Germany and Japan.

Analysts believe that Taiwan Semiconductor Manufacturing Company has great prospects, and can expect impressive growth by the end of 2024. The consensus forecast for TSM stock is a +78% growth in the next 12 months.

But before you click that ‘Buy’ button, remember to always do your research and make decisions based on it.