In today’s fast-paced business environment, staying competitive means staying current with your tools and technology. One essential aspect of your business operations that deserves your attention is payroll management. Payroll is the heartbeat of any organization, ensuring employees are compensated accurately and on time. However, as your business grows and evolves, so do the demands of managing payroll effectively, including creating and distributing accurate paystubs.

Today, we’ll explore whether it’s time for your business to consider upgrading its payroll software. We’ll delve into the signs that might indicate an upgrade is necessary, why payroll software is crucial, and how to choose the right solution for your specific needs. So, let’s begin by examining the importance of payroll software and the benefits it offers beyond just generating paystubs.

The Importance of Payroll Software

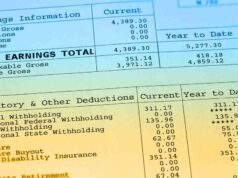

Before delving into the signs that might indicate an upgrade is necessary, let’s first establish why payroll software is so crucial for businesses of all sizes. At its core, payroll software automates the process of calculating employee salaries, tax deductions, and generating paystubs. The benefits extend far beyond simplifying these administrative tasks:

1. Streamlined Efficiency

Payroll software reduces the time and effort required to process payroll. It automates calculations, minimizing the potential for human errors, which can lead to compliance issues and unhappy employees. For instance, consider a scenario where you have to calculate overtime pay for multiple employees manually. With the right software, this becomes an automated task, saving you hours of work and reducing the risk of errors.

2. Compliance Confidence

Tax laws and regulations are complex and ever-changing. Modern payroll software is frequently updated to ensure compliance with local, state, and federal tax laws, reducing the risk of costly mistakes. This means that your software will automatically adjust to new tax rates and rules, preventing you from inadvertently violating tax regulations.

3. Employee Satisfaction

Employees rely on accurate and timely paychecks. With the right software, you can ensure that your employees receive their paystubs promptly and without discrepancies, fostering trust and satisfaction. Imagine the frustration an employee might feel if their paycheck is consistently incorrect or late due to manual payroll processing. Upgraded software can eliminate such issues, improving employee morale.

4. Reporting and Analytics

Advanced payroll software provides detailed reporting and analytics tools. These insights can help you make informed decisions about your workforce and budget. For example, you can generate reports that show overtime trends, helping you identify areas where you can optimize your workforce and reduce costs.

Now that we’ve established the importance of payroll software, let’s explore signs that it may be time for an upgrade:

Signs Your Business Needs an Upgrade

1. Manual Processes Are Overwhelming

If you find your team spending excessive time on manual data entry, calculations, and distribution of pay stubs, it’s a clear sign that your current payroll software may not be up to par. Upgrading to a more automated system can free up valuable time for strategic tasks. Consider the time savings when processing payroll for a large number of employees. With an upgraded system, this process becomes nearly effortless, allowing your team to focus on higher-value tasks.

2. Growing Workforce

As your business expands and hires more employees, the complexity of payroll management increases. Older, basic software may not be able to handle the additional workload efficiently. Modern payroll systems are designed to scale with your business. For instance, an upgraded system can easily accommodate the addition of new employees, ensuring that their paystubs are generated correctly and on time.

3. Errors Are Increasing

Payroll errors can lead to unhappy employees and compliance issues. If you notice a rising number of errors in your payroll process, it’s time to consider an upgrade. Advanced payroll software significantly reduces the risk of mistakes. For instance, a common error is failing to account for changes in tax codes. Upgraded software can automatically update tax rates and rules, preventing such errors.

4. Compliance Concerns

Tax regulations are subject to change, and non-compliance can result in costly fines and legal trouble. Ensuring your payroll software is updated to reflect the latest tax laws is essential for avoiding these pitfalls. Upgraded software typically includes regular updates to ensure compliance with changing tax codes, providing peace of mind that your payroll processes align with legal requirements.

5. Lack of Employee Self-Service

Today’s employees expect self-service options for accessing their paystubs, tax documents, and other payroll-related information. If your current software doesn’t offer these features, it may be time to upgrade to a more employee-friendly solution. Upgraded software often includes employee portals where workers can access their paystubs and W-2 forms and update personal information, reducing the administrative burden on HR teams.

6. Inadequate Reporting

If you struggle to generate comprehensive reports and analyze payroll data efficiently, you may be missing out on valuable insights. Modern payroll software often includes robust reporting and analytics features to help you make data-driven decisions. For example, upgraded software can provide detailed reports on labor costs, helping you identify areas where you can optimize staffing levels or allocate resources more effectively.

Choosing the Right Payroll Software

Once you’ve recognized the signs indicating a need for an upgrade, it’s essential to choose the right payroll software for your business. Consider the following factors:

1. Scalability

Ensure the software can accommodate your current workforce and scale as your business grows. Look for software that offers pricing and features suitable for both small businesses and larger enterprises.

2. Compliance Features

Ensure that the software remains up-to-date with the latest tax regulations and provides tools to ensure compliance. Some payroll software even offers automatic tax filing, simplifying your tax-related tasks further.

3. Integration Capabilities

If you use other software or systems for HR or accounting, choose payroll software that can seamlessly integrate with your existing tools. Integration can streamline data sharing and reduce the risk of errors.

4. Employee Self-Service

Look for software that empowers employees to access their paystubs and relevant payroll information independently. Ensure the employee portal is user-friendly and provides a secure way for employees to access their data.

5. Reporting and Analytics

Select software that offers advanced reporting and analytics to help you gain insights into your workforce and financials. The ability to create custom reports and dashboards can be invaluable for making informed decisions.

Conclusion

Payroll management is a critical aspect of your business operations that should not be overlooked. If you’ve identified any of the signs mentioned above, it may be time to consider upgrading your payroll software. By doing so, you can streamline your processes, reduce errors, and ensure compliance while keeping your employees satisfied with accurate and timely paystubs.

So, make the right choice for your business’s future by investing in modern, efficient payroll software. Remember that the right software can not only save you time and money but also provide valuable insights to drive your business forward.