Warren Buffett, often dubbed the “Oracle of Omaha,” is a name synonymous with astute investing. His unparalleled knack for picking value stocks has made him one of the world’s wealthiest individuals.

In today’s tumultuous economic climate, characterized by inflationary pressures, geopolitical tensions, and pandemic-induced uncertainties, many investors are left wondering: What’s Warren Buffett betting on now?

Interestingly, many investors, both novice and seasoned, often mirror Buffett’s moves, hoping to glean some of his Midas touch.

The Oracle of Omaha’s Legacy

For over half a century, Buffett’s investment choices, made through his conglomerate Berkshire Hathaway, have consistently outperformed the S&P 500 futures chart.

Since taking the reins in 1965, he’s managed to achieve an aggregate gain of more than 4,380,000% for Berkshire’s Class A shares. This feat becomes even more impressive when juxtaposed against the S&P 500’s return of less than 30,000% during the same period.

One of the tools that analysts and investors use to track Buffett’s moves is Berkshire Hathaway’s Form 13F filings. These documents, filed quarterly, provide a transparent view of the company’s stock purchases and sales, offering a window into Buffett’s current investment mindset.

Mastercard: A Screaming Buy

In the realm of payment processing, Mastercard stands as a titan. However, like all giants, it faces its share of challenges.

The current health of the U.S. economy, marked by its cyclical nature, poses a significant concern. Economic downturns can lead to reduced consumer and enterprise spending, which could dent Mastercard’s revenue, primarily derived from merchant fees.

But here’s the silver lining: economic downturns, historically, are short-lived. Mastercard, with its global presence, stands to benefit from prolonged economic expansions. Moreover, the company’s strategic decision to avoid lending shields it from potential loan losses during recessions.

This not only provides it a competitive edge but also ensures a swift recovery post downturns. Additionally, in an inflationary environment, Mastercard stands to gain. As prices rise, so do the merchant fees, leading to increased revenue.

Coca-Cola: The Timeless Investment

Coca-Cola, the beverage behemoth, holds the distinction of being Berkshire Hathaway’s longest-held investment.

While some might dismiss it as a “boring” stock, its global presence and brand recognition are unparalleled. Despite challenges like unfavorable currency movements and price hike pushbacks, Coca-Cola’s growth strategy remains unthreatened.

The company’s operations span almost every country, ensuring a steady cash flow. With 26 brands each generating at least $1 billion in annual sales, its financial health is robust.

Moreover, its innovative marketing campaigns, leveraging both digital media and traditional brand ambassadors, ensure it remains relevant across diverse demographics.

Snowflake: Proceed with Caution

Snowflake, a rising star in the data-warehousing sector, presents a conundrum for investors. On one hand, the global trend towards cloud computing and Snowflake’s innovative solutions position it as a front-runner in the tech space.

Its transparent pricing strategy, which is based on the amount of data stored and compute credits used, coupled with its seamless data sharing capabilities, make it a favorite among businesses. However, looming economic uncertainties, especially in the tech sector, and a noticeable deceleration in its growth rate are concerning.

Additionally, its current valuation seems steep, prompting investors to exercise caution. It’s crucial to weigh the company’s long-term prospects against the immediate risks and market volatility.

The Importance of Diversification

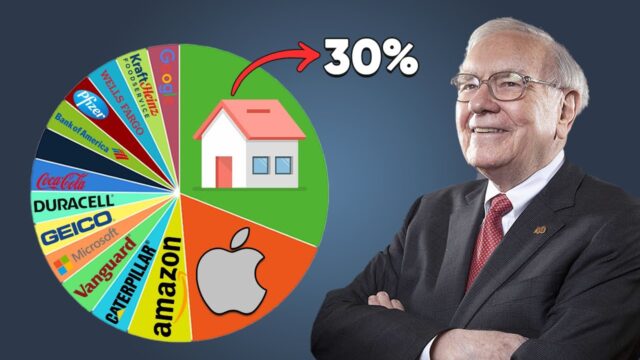

Buffett’s investment portfolio, characterized by its eclectic mix of stocks, is a testament to the importance of diversification.

By strategically spreading investments across various sectors, he effectively mitigates risks associated with downturns in any single industry. While we’ve touched upon a few notable names like Mastercard and Coca-Cola, it’s worth noting that Buffett’s portfolio boasts over 50 securities.

Each of these investments is chosen with meticulous care, deep research, and foresight into market trends. This diversification strategy, apart from minimizing risks, ensures a steady stream of returns. It acts as a safety net, ensuring consistent returns even when individual stocks or sectors face challenges.

Buffett’s Approach to Emerging Markets

Warren Buffett, traditionally known for his conservative investment approach, has shown increasing interest in emerging markets. These markets, characterized by rapid industrialization and higher than average growth rates, offer a tantalizing prospect for investors seeking substantial returns.

Buffett’s foray into these markets is not just a testament to their potential but also a strategic move to diversify his portfolio further. Countries like India, Brazil, and parts of Southeast Asia have seen significant investments from Berkshire Hathaway in recent years.

These investments are often in sectors that align with Buffett’s philosophy: industries with a moat, consistent revenue streams, and a clear growth trajectory. While emerging markets come with their set of challenges, including political instability and currency fluctuations, Buffett’s entry signifies his confidence in their long-term potential.

The Role of Technology in Buffett’s Portfolio

Historically, Buffett steered clear of the tech sector, citing his principle of investing only in what he understands. However, the recent inclusion of tech giants like Apple and Snowflake in Berkshire Hathaway’s portfolio indicates a shift.

This change can be attributed to the undeniable influence technology has on the global economy and everyday life. While Buffett remains cautious, his tech investments are strategic. He focuses on companies with a strong brand presence, robust ecosystem, and a sustainable competitive advantage.

The tech sector’s dynamic nature requires a different evaluation approach, but Buffett’s fundamental principles remain unchanged: understanding the business, its value proposition, and its growth potential. As technology continues to reshape industries, it will be intriguing to see how Buffett’s tech portfolio evolves.

Lessons from Buffett’s Investment Strategy

Warren Buffett’s investment strategy is not just about picking stocks; it’s a philosophy rooted in core principles that have stood the test of time. Central to his approach is the emphasis on understanding the intricacies of a business, its market position, and its growth potential.

He also stresses the importance of adopting a long-term vision, steering clear of the myopic view that often plagues investors. Furthermore, Buffett is a firm believer in the principle of value investing, ensuring that one pays a fair price for any stock.

While the allure of quick, short-term gains can be hard to resist, Buffett’s success story underscores the unmatched value of patience, diligence, and thorough research in the world of investing.

Conclusion

Warren Buffett’s investment choices, made in the backdrop of an uncertain economic climate, offer valuable insights for investors. Whether you’re a seasoned investor or just starting, taking a leaf out of Buffett’s book can guide your investment journey.

Remember, informed decisions, backed by thorough research and a clear understanding of the business, are the cornerstones of successful investing. Let Buffett’s strategy inspire and guide your investment choices.

If you are interested in investing, read our article on must-read investing books among which is the one Warren Buffet himself endorsed.