Online casinos have grown increasingly popular in recent years, with the proliferation of smartphones, faster internet, and the convenience of gambling from the comfort of one’s home contributing significantly to this trend. With the world grappling with pandemic-related restrictions, the shift towards online gaming has only become more pronounced.

However, one overlooked aspect of online gambling is its tax implications. When your virtual chips translate to real-world money, Uncle Sam is interested. This blog post aims to enlighten gamblers about the taxing side of online casinos, preparing you to responsibly handle your gambling-related income.

Understanding the Tax Basics

Before delving into the specifics of gambling taxation, it’s important to understand the concept of taxable income. Simply put, taxable income is the portion of your total income that’s subject to tax, including wages, tips, bonuses, and yes – gambling winnings. Every country has its own tax jurisdiction, and these come with varying regulations. For instance, the U.S. considers all gambling winnings as taxable income, whereas some European countries only tax professional gamblers.

Taxation on Gambling Winnings

The Internal Revenue Service (IRS) in the U.S. states that all gambling winnings, regardless of amount, are subject to federal income tax. However, the IRS only requires the casino to report wins over a certain threshold, which varies depending on the type of game. Casinos must also withhold a percentage of your winnings as federal withholding tax if your winnings minus wagers exceed certain thresholds. This is the primary reason why some of you should consider offshore options such as netti kasinot and similar outlets.

The tax treatment differs for professional gamblers and casual players – professionals can deduct their losses and expenses against their winnings, while casual gamblers can only deduct losses against their winnings, and only up to the amount of their winnings.

Deducting Gambling Losses

Losses from gambling can be deducted from your tax bill, but there are strict guidelines. You must itemize deductions on your tax return, and your losses cannot exceed your winnings. Furthermore, proper documentation of losses is crucial. This includes keeping receipts, tickets, or statements showing the amount of both your winnings and losses.

Reporting Requirements for Online Gambling

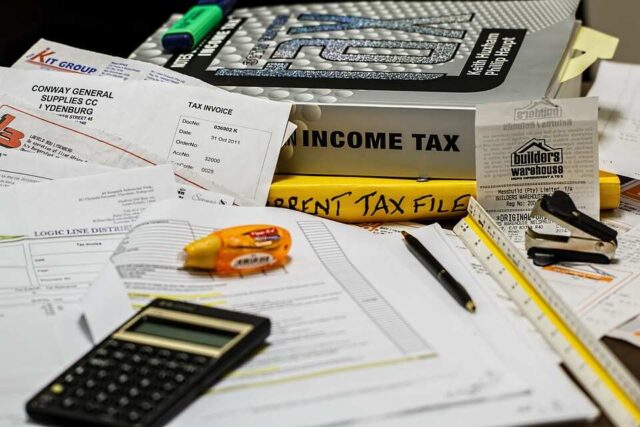

The IRS expects you to self-report your online gambling winnings. Form W-2G is used to report gambling winnings and any federal income tax withheld on those winnings. Failing to report these winnings can result in severe penalties, including criminal charges for tax evasion.

State-Specific Tax Considerations

When it comes to gambling taxation, state laws introduce another layer of complexity. Some states in the U.S., for example, impose an income tax on gambling winnings, while others exempt these winnings from taxes altogether. Certain states only tax residents on their gambling winnings, while others tax both residents and non-residents.

That’s why it’s crucial to research your state’s specific requirements and integrate these into your overall tax strategy. Remember, it’s not just about the IRS; understanding your state’s stance on gambling taxation can significantly impact your net winnings.

International Gambling and Taxation

When gambling extends beyond your home country’s borders, taxation becomes even more intricate. This is particularly relevant in the era of online gambling, where players can virtually visit casinos hosted in various countries with a click of a button. Tax treaties between countries can significantly impact how your winnings are taxed.

It’s essential to comprehend the tax laws in your home country and the country hosting the online casino. For instance, while some countries don’t tax gambling winnings, they might require taxes to be paid if the winnings are remitted back to the country. This is a complex issue, and sound advice would be to consult with an international tax expert.

Record-Keeping Tips for Gamblers

For gamblers, maintaining a detailed record of your gambling activities is more than a good practice—it’s a necessity. An organized logbook recording your wins and losses, the type of gambling, dates, and locations can significantly streamline your tax preparation process. This habit is not just about tracking your overall profit or loss. It also ensures that you report your income accurately, which is crucial given the IRS’s strict reporting requirements.

Furthermore, in case of any audits or discrepancies, having a thorough record of your gambling activities can provide invaluable evidence to resolve these issues effectively. From jotting down notes in a physical diary to using digital apps designed for this purpose, choose the method that works best for you and stick to it.

Professional Gambling and Self-Employment Taxes

Professional gamblers not only face income tax but are also subject to self-employment tax. As a professional gambler, the tax code allows you to deduct expenses beyond losses, opening up the possibility for deductions like travel, research, and home office expenses. This can significantly offset your tax liabilities, but it requires diligent record-keeping and precise tracking of expenses.

Also, it’s crucial to understand the specific criteria the IRS uses to determine if you are a professional gambler. Remember, being categorized as a professional gambler might significantly impact your tax liabilities, but it also comes with its own set of responsibilities.

Tax Strategies for Minimizing Liability

There are numerous legal strategies to reduce your taxable gambling income, including offsetting winnings with losses. However, these should be used cautiously and within the legal limits. Strategies such as bunching losses in one year to offset substantial winnings or spreading winnings over multiple years can be considered.

Additionally, itemizing deductions to include gambling losses can also lower your taxable income. These are complex strategies, so consulting a tax professional to understand how they could work for your individual circumstances is highly recommended.

Common Tax Pitfalls and How to Avoid Them

The most common tax mistakes include underreporting income, failing to keep accurate records, misunderstanding state tax laws, and not knowing when to file as a professional gambler. Such missteps can result in tax audits, penalties, or even criminal charges for tax evasion.

Educating yourself about these common pitfalls is the first step towards avoiding them. Consider leveraging tax software or hiring a tax professional to help with your tax preparation. Additionally, keep an eye out for reputable online resources and updates on gambling taxation to stay informed and prevent any tax mishaps.

Conclusion

A solid understanding of the tax implications of online gambling is crucial for both casual and professional gamblers. This knowledge allows you to be responsible and well-informed in your gambling activities, equipping you to maximize your earnings and minimize your liabilities. This guide provides a comprehensive overview, but due to the complex and changing nature of tax laws, it’s always advisable to seek professional tax advice for accurate reporting.

Remember, the importance of staying informed extends beyond improving your game—it’s also about safeguarding your winnings and avoiding unnecessary legal complications. The world of online gambling is full of thrill and potential financial reward, but it’s also an area that requires responsibility. A smart gambler is a well-informed gambler.