The price of bitcoin is always in a state of flux, with a plethora of factors affecting market sentiments. Fundamental factors such as governments declaration and the activities of whales affect how traders and investors act in the market.

Now and again, there is always that one news that swings the market’s emotions, either causing the price of bitcoin to rise or fall. And the last ‘government-related’ news that caused a stir in bitcoin’s price was China doubling down on their efforts to stop mining in China.

Why Has China Been Hard on Cryptocurrency and Bitcoin Mining in China?

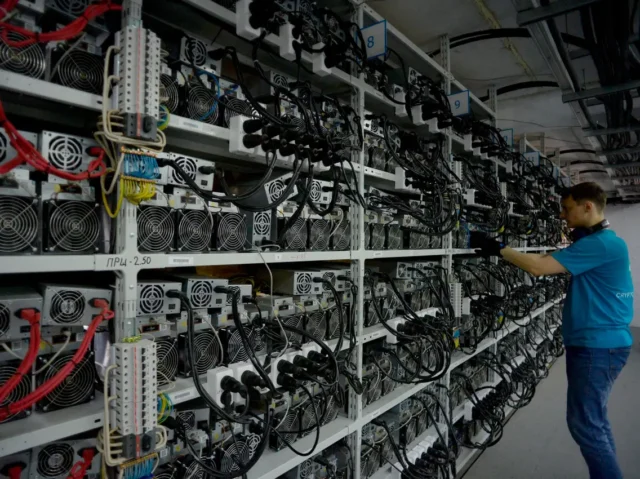

The ban from the Chinese government on China Mining was a big hit, negatively, for the market. China has been cracking down on miners in the country because the government, like Russia, believes that cryptocurrency has become an avenue for looters to hide their looted wealth. China has also been heavy on miners because they, China, want to reduce the number of greenhouse gases they emit. Bitcoin mining consumes a lot of energy, thus making it inevitable for miners to use tonnes of energy while mining.

Also, as the hash rate for mining bitcoin increases, the amount of energy needed by the computers being used by miners increases.

Therefore, the Chinese government has been hard on miners and anyone who trades cryptocurrency in the country.

What Was the Implication of the China Ban?

When the news of China banning bitcoin miners in the country came out, the market suffered heavily. In the first 24 hours, bitcoin lost 4% of its price, causing investors to lose, and traders in the futures market to get liquidated.

The market was sceptical about the market’s direction as most bitcoin miners in the world were in China. The fear was so palpable that the fall in BTC price was on the negative side of growth for more than a week.

But the market eventually recovered. And more! Bitcoin’s price has risen by almost 50% since the ban.

What Happened After the Ban?

After the ban on crypto mining in China, many of the China miners either moved out of the country or stopped mining altogether. In the past, miners could mine bitcoin in small corners of the country, so long they hid from plain sight.

But after the Chinese government intensified their efforts to arrest and jail anyone involved in mining crypto or trading or accepting it for payment, miners decided to relocate to other countries and those who couldn’t stop mining altogether.

Was It a Bad News for the Cryptocurrency Market?

Yes, at first, the ban had a negative effect on the market, but the market corrected, and the price of bitcoin rose and rose. The effect of the ban, many have termed, a good move for cryptocurrency and bitcoin. Why is that? Why should such news be something to be happy about?

Bitcoiners Thank China for the Ban

Bitcoiners around the world are more than grateful to the Chinese government for the ban on crypto miners and everything cryptocurrency-related as it led to an increase in the price of bitcoin.

Before the ban, bitcoin’s price was around $43,000, having fallen from August. The news of the ban was so bad that the price fell by 3.6%, which signalled the whales and other small investors to enter the market.

As more people bought the dip, all anticipating a price upsurge, the price started retracing.

Since that ban, bitcoin has risen to as high as $63,000.

Aside from the influx of big financial players in the crypto market, the decrease in hash rate has also been a major factor in the excitement of bitcoiners worldwide.

Hash rate is the total computational power that is needed to mine and process transactions on the blockchain.

In simple words: Hash rate is what ensures that a transaction is marked verified by miners on the network. With a 50% decrease in hash rate, the energy needed to complete each mining is reduced and more miners can profit from the mining process.

The ban also helped to spread the number of miners across different countries. Although the United States of America has more miners in the country, 34.5%, the Chinese ban led to a more decentralized mining ecosystem.

All around, the ban by the Chinese government has brought more positives than negatives to the cryptocurrency space. Recent data showed that more people are buying and selling bitcoin. On exchanges such as Redot.com, traders and investors are buying bitcoin with reckless abandon.

What’s Next for Miners

The migration of miners from China to other parts of the world has also affected miners’ behaviours.

One would have thought that after the price slump, miners would be quick to let go of their bitcoins, but the reverse has been the case. More miners are choosing to hold their bitcoins, waiting for the pump, and if possible, an outright blow off in the nearest future.

Miners are holding onto their coins because. Despite miners’ bitcoin reserves remaining low, according to on-chain analytics from cyberQuant, these miners are playing the long-term game.

Miners have also been keen on keeping up the bitcoin market’s fundamentals.

Although Whales have dumped their coins in the past, seeking to manipulate the price, the market still looks promising. As more big industries and financial giants enter the bitcoin and cryptocurrency turf, the adoption of bitcoin increases.

The proposed bitcoin ETF is also an open door for sceptics to get into the market, which will inevitably increase bitcoin’s value. As more people see the benefits of accepting cryptocurrency payments; as countries accept bitcoin in their economy; as multimillion industries such as Facebook get involved with blockchain and NFTs; as hedge funds buy bitcoin and altcoins, the price will increase.

Miners know that the future of bitcoin – and by extension cryptocurrency – is good. It is only common sense that they hold onto their bitcoin and wait for the pump.