There are many people who have issues with saving enough money to buy a new car, replace some devices at home, buy new clothes, or go on a vacation. It is a common practice that lasts for a long time that people often choose to take loans instead of struggling with saving enough money.

However, it is important to never rush with your decision and choose the first option you see when you need more money. There are different options available, and differences between them can be crucial. The first thing you should do is to check the details of the contract and see how much money you will return over time.

The main difference between various options is related to the length of the contract and the amount of money you can get. In case that you don’t need a lot of money since you only want to invest in some house repairs, new car, or a vacation, the most common option is a consumer loan. Here are the most important things to check before applying for this option.

1. Why Do You Need It?

As we already mentioned, it is important to never rush with your decision. Keep in mind that this option comes with a price, and saving instead of getting a loan can be a much better solution in some cases. The best way to understand this is to compare the prices and additional fees that you will have to pay over time. For example, you need additional $3,000 for a vacation. In most cases, you will have to pay over $300 on fees and there might be some other expenses as well. You can get this amount of money quite easily, and return it in a year or two through monthly installments.

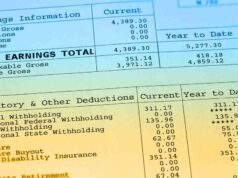

Still, saving cash from your wages is always much more affordable. The process is the same as when you are getting a credit to buy some device. For instance, when you need a new iPhone, which costs around $1,000, it might seem easy to pay it off through monthly installments that will be around $100. However, when you check the calculation, you will notice that you have paid over $1,200 for a device that costs $1,000 when you pay in cash.

2. Compare the Fees

There are many financial institutions available on the market, which means that high competition can make a difference and lead to some benefits for users. Therefore, be sure to compare the deals offered by different banks and other places where you can get a loan. The difference of 1% or 2% might not seem so important, but if you are getting a bigger amount of money, it will lead to saving hundreds of dollars.

3. Check the Requirements

Not all of these options are offering the same terms for getting the money. For example, some of them might require a collateral, or must have a higher wage, better insurance policy, and other features. In case that you are not allowed to get a loan in one place, there might be another one where you can get the money. Still, it is common that banks and loan agencies will include higher expenses for those who are not capable of getting the money through standard process since they don’t comply with some requirements.

4. Pay Attention to Hidden Expenses

There are all types of tricks banks and loan agencies are using to get more money from their clients. This is another reason to be focused and never rush with your final decision related to the selection of the bank and the amount of money you will get. For example, one option might include the processing fees, and if you don’t notice it before signing, you will have to pay additional few percent of the total amount.

Another important thing is related to potential delays. It is common that they will add additional fees, and you might end up paying almost the double of what you took if you don’t pay it off during the determined period.

Also, check if there is the possibility to pay it off before the end of the contract, and what fees will be included in that case. The best option is to look for those type of loans where paying off before the end of contract won’t include the calculated fees for the full period.

5. Your Credit Rating is Very Important

Before you start looking for various options, be sure to check your rating in the current system so you can know where to start. In case that you don’t have a good rating, keep in mind that getting an affordable deal will be very difficult.

Also, there are many agencies that will refuse your application. In that matter, you will have to deal with those options interested in providing funds to people with lower rankings, but they will include much higher fees. Still, it can be a good solution to improve your ranking over time. However, be sure to pay it off in a determined time so you don’t face even more problems.

Last Words

Loans are very popular in the whole world. They help people to feel less stressed about their wages and savings. When you want to buy something, saving enough money for that might seem impossible when you are trying to save it by not spending the part of your wage each month. That is especially the case with more expensive things like cars or houses.

On the other side, the focus of consumer loans is on lower amounts that people can use to buy clothes, go on vacations, invest in appliance and devices, and more. Even though fees for this option are much higher when compared to other types of loans, the advantage is that process of getting it is much easier, while the time of paying it off is short as well.