Investing in cryptocurrencies can be scary at first. Before even diving into the crypto ocean, there is a lot that you need to comprehend first. It may appear to be excessive at times.

But the uplifting news is that you can practice habits to turn yourself from a bitcoin skeptic to a true cryptocurrency investor. These are essential behaviors and habits for cryptocurrency investors, and if you want to succeed in this market, you’ll need to practice them in some fashion.

These habits can help you better understand the stock market, increase your chances of success, and safeguard you and your investments. If you’re planning to invest in cryptocurrencies, here are four healthy habits to develop.

1. Stay Updated

The most important habit that successful crypto investors attribute to their success is their willingness to learn. While there is always risk in trading and investing, the risks of making a bad decision can be reduced by making intelligent and data-driven selections. As a result, it’s critical to be prepared to understand any new and essential knowledge on trading and investing in cryptocurrencies. After all, just like buying stocks, the value of cryptocurrency can fluctuate dramatically due to a single event, global news, or simply a tweet.

Additionally, as you practice this learning skill, you will improve. However, you can improve your learning skills as well. With the value of cryptocurrency fluctuating so rapidly, it’s critical to stay on top of all the information you’ll need to make informed decisions. This can be accomplished by reading the greatest books or articles and implementing new tactics right away.

Reading the news every day and honing your learning skills is one of the best ways to keep your crypto trading knowledge up to date. This helps you learn about current trends and ones that have passed their usefulness. It’s also critical to cultivate the practice of conducting extensive research before making any judgments since this will allow you to track and evaluate patterns.

Stay updated on the cryptocurrency market by visiting phandroid.com.

2. Always Have A Plan

One of the most significant habits of great cryptocurrency traders is that they never make decisions without a plan. This comprises tactics, risk management, objectives, and constraints.

A varied portfolio is a popular approach adopted by traders when it comes to risk management. This involves diversifying your assets rather than placing all your eggs in one basket. You can, for example, invest in Solana and Ethereum in addition to Bitcoin. As a result, in the case of a decline in the price of one of your assets, your overall losses will be reduced.

Next, you must create your strategies while also enhancing them. The best literature on the subject will never tell you to stop. This is necessary in order to obtain consistent results and avoid any biases. It’s also crucial that you enhance it in order to achieve better results. This can be accomplished by keeping a log of all your transactions, which will help you reflect, identify your errors, and improve your strategy. Goals are also vital because they will serve as your compass and brakes in your plan and let you measure your success.

3. Make Security A Top Priority

The security of bitcoin is one of its most enticing features. Hacking, counterfeiting, and double-spending are nearly impossible with cryptography and blockchain technology at their core. However, this may lull some cryptocurrency investors into a false feeling of security. The way the currency is incredibly protected doesn’t mean it is difficult to steal.

Cryptocurrency can be susceptible while stored in crypto wallets; what’s more, there have been various hacks and attempted breaks on trades throughout the long term, including a few prominent ones where hoodlums grabbed enormous amounts of cash. It is basic to have solid security propensities while exchanging digital currency.

Make sure you select a crypto wallet that provides you with the level of access to your currencies that you require while maintaining the highest level of security. You should follow excellent online security habits and implement two-factor authentication on your accounts when possible. Likewise, with any gadgets that have crypto or crypto-related accounts on them, practicing great actual security-this is a crucial part of safety.

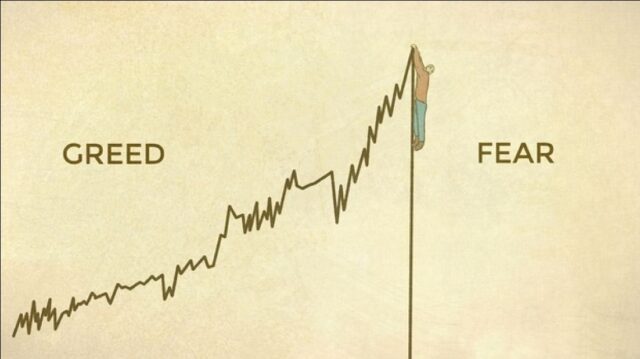

4. Eliminate Greed And Fear

Another habit that any good investor should develop is eliminating greed and fear factors. Because of several factors, every human being may succumb to greed at some point. For example, an investor who has made over 90% profit on a transaction will naturally want more if the market continues to rise, even if the aim is 90%.

This is where discipline comes into play. A disciplined trader would cope with greed over time, take profit, and exit the transaction since such a person has learned that the market can shift directions, dump, and leave such a trader in the negative.

Another issue that must be addressed is fear. At some point in their existence, every species will experience fear. However, professional investors must have mastered avoiding their emotions when trading; fear is a key barrier for investors. When a trader/investor who has taken the time to evaluate the chart notices that the market isn’t moving in the correct direction, fear sets in, signaling a trade loss.

A skilled investor, however, will not be concerned. A skilled investor understands that the market may fall before retracing, that losses are inevitable in investing and that losses can be made up for with smart investments.

Conclusion

Due to a large number of successful crypto traders, cryptocurrency has shown to be a very profitable investment. Cryptocurrency trading has advantages and disadvantages, such as security and volatility. You’ll never know whether you’re making the ideal cryptocurrency investment; additionally, it can be quite rewarding if you take advantage of times when their value skyrockets.

However, because Bitcoin investment is extremely risky, you must do it correctly with the necessary tools, methods, and habits. Hopefully, after reading the above post, you’ll be well on your way to cryptocurrency investment with the right tools and tactics.