When you start a new company in Canada, or you want to level up the game in your current one, don’t forget about hiring a professional accountant.

But, why do you need one?

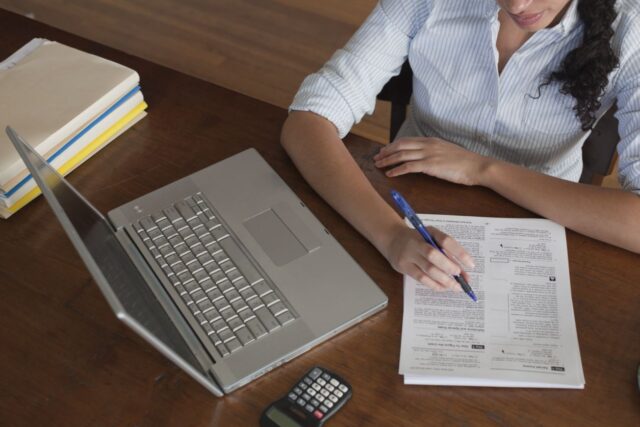

Business owners, CEOs, and managers should be aware of the accountant’s importance in any company. These people are professionally trained to keep up with the most recent law changes and implementations. They know how to calculate taxes, and build a finance culture within the corporate structure. Most of the time, accountants work on taxes and money planning.

This is only one reason why the corporate accountant is an essential part of any company. Additionally, these professionals often know how to handle complex paperwork, advanced bookkeeping, and even regular financial reporting, while using their skills, combined with specialized software for that purpose.

In general, all accounting activities are regulated by Canada Revenue Agency, and accountants follow those regulations before providing any type of service.

So, if you have a business in any Canadian city, you have to ensure everything follows the country’s laws and regulations. Most of the time you will need these services:

Financial reporting

Keeping track of expenses, growth, and revenue is an essential part of successful businesses. A professional accountant will prepare journals, reports, statements, cash flow charts, and balance sheets, so you always know how things go in the finance sector.

Bookkeeping

Bookkeeping is something you need to have from the first moment you establish the company. It gives you an insight into every transaction, including raw data for every dollar spent or earned. It’s an essential part of every business, so bookkeeping is something you shouldn’t skip, especially if you have many clients.

Business consulting

The accountant may help you plan your expenses, or even create a strategy to follow. Many companies face some financial issues, but the right accountant will help you with budgeting, cost management, deductions, planning, and any expense you may have as a company.

Tax management

When you need to handle many tasks, tax management can be pretty overwhelming. But, professional accountants make all these things so easy to manage. They know everything, including current laws, tax requirements, and payment obligations. So, instead of doing it yourself, hire an accountant to handle this part of the business.

Tax obligations of Canadian companies

Depending on what kind of company you are in, then you have different tax obligations. According to Canadian laws, corporations are divided into four categories, namely CCPC (Canadian-Controlled Private Corporation), public corporation, subsidiary of a public corporation, and a whole category that covers other private corporations.

CCPC has certain benefits, benefits, and tax obligations. They usually have to pay 9% in lieu of tax, but the professional accountant has the obligation to check if all the conditions are met for this.

Public corporations have certain tax benefits, such as long-term viability, access to capital, as well as separate legal entities. Also, subsidiary companies are under the control of public corporations and the conditions for internal regulation apply to them. Only when the tax is paid do they fall into a different category and need to fill out a T2 Corporation Income Tax Return.

All other private corporations are governed by Canadian law. The only condition is that they are not in ownership or any control of public Canadian companies.

How can an accountant help you work easier?

Every country in the world, including Canada, has specific financial laws and regulations that place a number of obligations on both the public sector and citizens. A company cannot function without an accountant and bookkeeper. Nowadays, an expert knows all these details and can contribute to transparent financial maintenance and reporting of a company.

Accountants have a clear insight into all inflows and outflows in a company, as well as expenses and taxes. These professionals are often also licensed to make and correct financial decisions, perform audits, review previous bank statements, etc.

When do you need an accountant in a Canadian company?

Sometimes tracking your financial situation becomes impossible, especially if you are focused on goals and future development. Each employee has his own role, and finance requires advanced knowledge of the world and local economy, political situations, and financial operations.

Keep this in mind if you are starting a new business yourself, no matter what type it is. Whenever you start something new in Canada, it means that you have a number of responsibilities, whether you are a sole proprietor, an associate, or a partner in the business.

Therefore, there are several situations in which it is inevitable to have an accountant:

– Budget planning, so that you know at any moment what your financial obligations are.

– Cash flow management, to know if you realize the minimum benefits and projections.

– Tax planning, because the tax system carries a large number of obligations for business users.

– Payroll management, because at any moment you have to process a large amount of money for different purposes.

– Categorization of invoices and assistance in collection and payment of expenses.

– Benefits for each employee, depending on their previous experience, the complexity of the workplace, and additional obligations such as health and pension insurance.

In general, the recommendation is to have an employee accountant in the company. At least one is enough to start with, but over time the need for a new employee may arise.

Conclusion

Knowing all these things, you realize how important is to have a reliable and professional accountant by your side. These people handle so many essential tasks, and it’s not even possible to run a company without this person being a part of the team.

If you are a Canadian resident who plans on establishing a new business, hiring an accountant must be your priority, even in the earliest stages of working. If you can’t afford to hire a person as a part of the in-house team, consider using an agency to help you figure out your financial obligations.

But never hold onto someone who claims they know accounting and bookkeeping because mistakes can be made. Hiring a professional is a must, no matter how easy you think financial work is.